We are so BACK. Pump regains market share, ETH blasts through $4k

Market Vybe Issue #19

Volatility got you spooked? Don’t panic, Ibiza Final Boss is here to save crypto. Markets shook off last week’s FOMC & tariff jitters thanks to huge regulatory tailwinds. Bitcoin reclaimed key levels, Ethereum blasted through $4K(again), and Solana’s on-chain activity is at all-time highs.

Here’s your weekly breakdown 👇

Market Overview & Technical Analysis

Bitcoin (BTC)

Last week’s macro uncertainty and tariff fears rattled broader markets, sending ripples through crypto. BTC is holding a fragile range between $110K–$119K, with $116K emerging as the key battleground. A breakout here could put $130K back on the table for August.

Ethereum (ETH)

ETH has been the standout performer, up 14% this week and outpacing both BTC and SOL. With spot ETF demand climbing and treasuries companies loading up, ETH is testing the $4K mark ~ a breakout here could lead it back to all time highs ($4,878 from 2021).

Solana (SOL)

Solana’s been on a rollercoaster: Going from $204 to $155 in just 10 days will bring even the most seasoned crypto investor to his knees. Price has since recovered back to $177 (at the time of writing), and it looks like we’ve rebounded off the purple trend line. All eyes are on the $185 and $200 resistance levels, a clean break could see SOL extend gains quickly.

Macro & Regulatory Tailwinds

Several bullish headlines have propelled the market higher this week:

China is quietly preparing to issue its first yuan-backed stablecoin, aiming to challenge US dollar dominance globally.

Trump administration crypto working group proposes landmark legislation — SEC/CFTC cooperation, safe harbors, and DeFi sandboxes.

President Trump signed an executive order Thursday that will let Americans invest their 401(k) retirement savings in cryptocurrency, private equity and real estate. This opens crypto to an addition $8 trillion in capital.

SEC vs. XRP case finally ends after decades of drama — XRP rallies 20%+.

Solana Ecosystem News

The Memecoin Wars

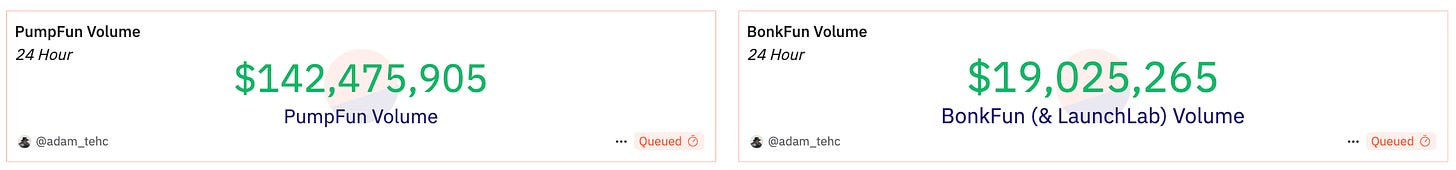

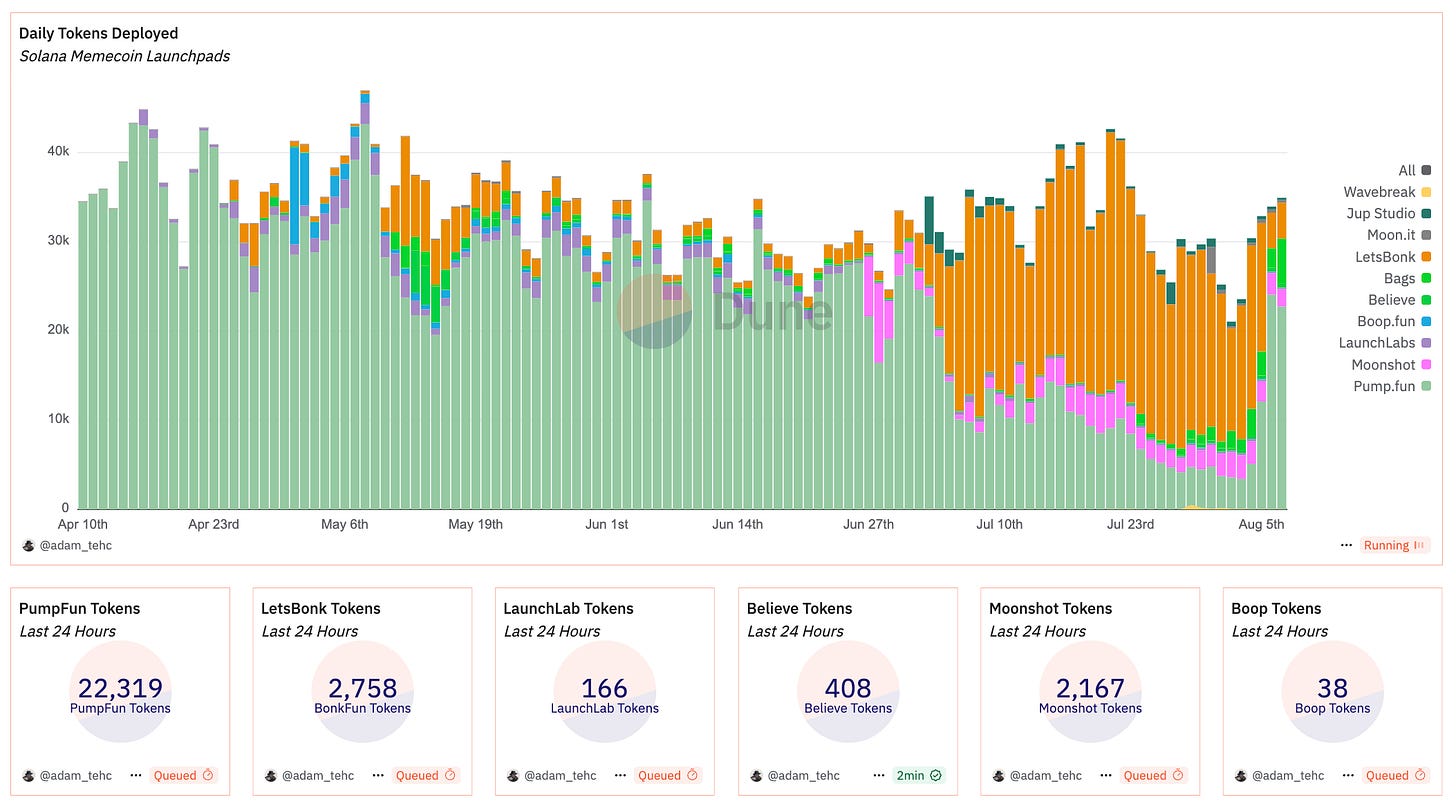

Last week BONK commanded 80% of all launchpad volume. Today, it’s less than 15%. As Toly once said, “There is no moat.”

Pump has regained dominance in the memecoin market after the founder Alon promised to support ecosystem tokens. The PUMP token has rallied 43% from its lows two weeks ago.

Pre-IPO Access on Jupiter

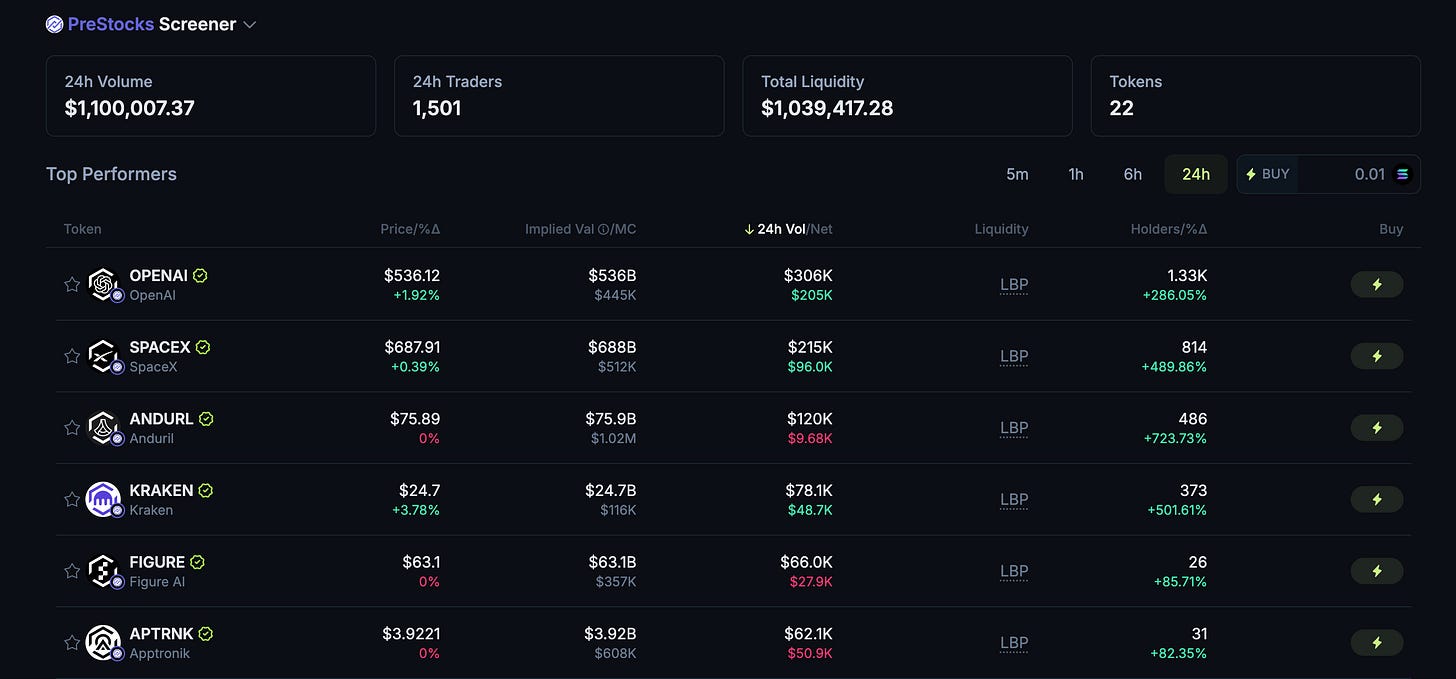

PreStocksFi, a platform specializing in tokenizing pre-IPO stocks, announced that its tokenized pre-IPO shares are now tradable on Jupiter, Solana’s top DEX aggregator. This move enables users to trade shares of prominent private companies 24/7, leveraging Solana’s high-speed, low-cost blockchain infrastructure. previously this kind of access was limited to accredited investors.

Solana ETF Watch

SEC delays decision on Grayscale Solana ETF to Oct 10, 2025.

VanEck and 21Shares ETFs remain under review.

Liquid Staking Clarity

SEC confirms liquid staking tokens are NOT securities. Bullish for VybeSOL and other LSTs.

Phantom Acquires SolSniper

Phantom snaps up AI-powered memecoin analytics platform SolSniper.

Solana Mobile

Seeker smartphones now shipped to 50+ countries (150K units distributed).

Solana Mobile Hackathon wraps up — though marketing could’ve been stronger.

Pudgy Penguins x Play Solana

Launching limited-edition Gameboys tied to PENGU token burns — bridging physical and digital collectibles.

Vybe Update – Draw Season 1 Recap

Season 1 was a big success — thanks to everyone who participated!

By the numbers:

160 VybeSOL distributed (~$28,000 USD) to 24 winners

Average staking APY over the season: 6.65%

Final total staked: 4,644.8 SOL

We’ll now be taking a short break before Season 2, which will launch with a new prize structure and even more ways to earn.

That’s all for this week’s newsletter. Markets are heating up, Solana’s ecosystem is expanding, and VybeSOL holders are stacking yield.

Thanks for reading! and as always, stay Vybin’.