US-China Trade War Ramps Up: Gold Surges, Where Does Crypto Go Next?

Market Vybe #24

The USA–China trade war has gone from spicy to nuclear, dragging both the stock and crypto markets into the mud. Meanwhile, Gold, Silver and rare earth metals are seeing massive capital inflows. It’s tariffs, tantrums, and a touch of déjà vu..

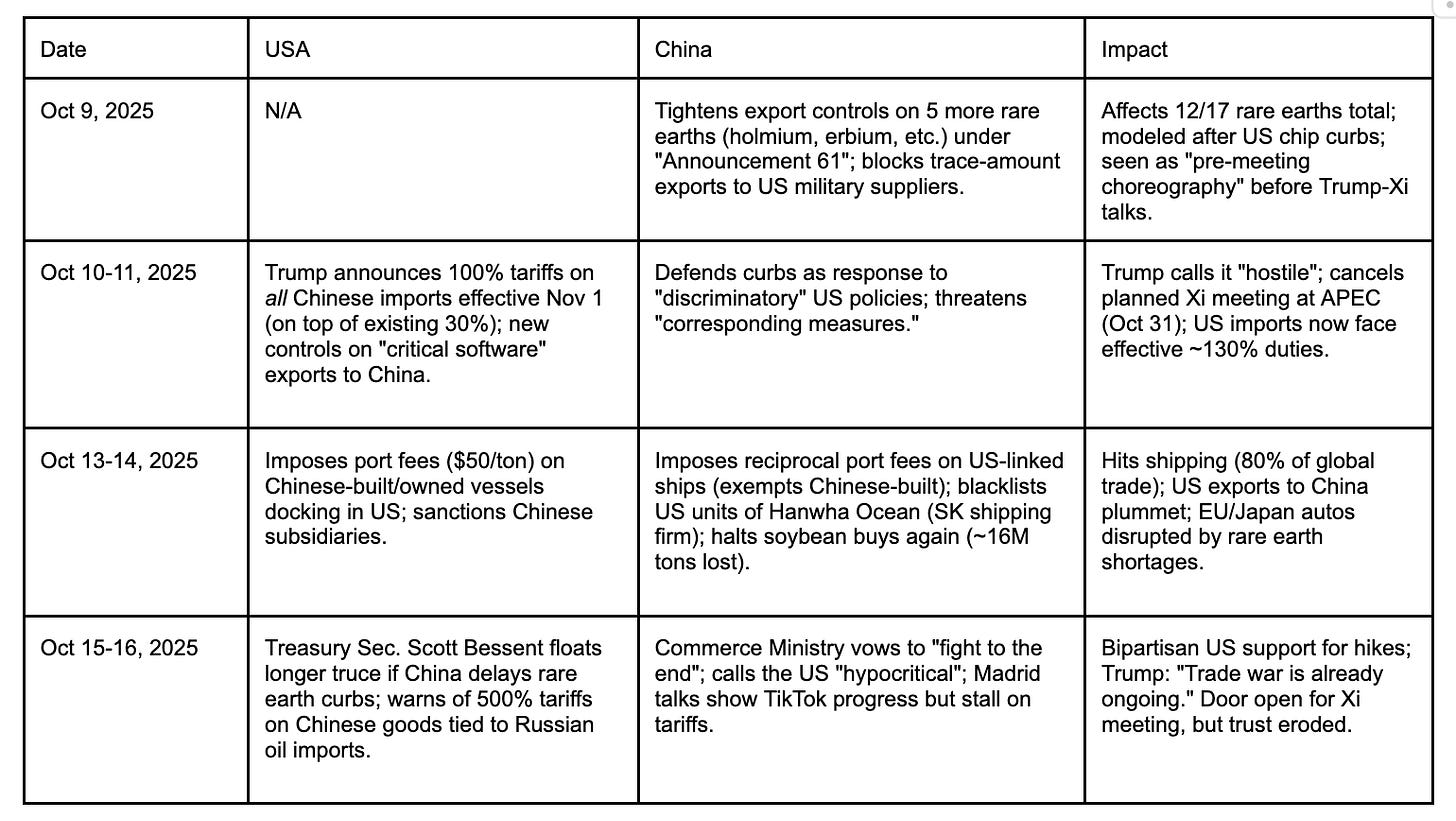

A brief timeline of escalating events:

What’s Next?

Nov 1: 100% U.S. tariffs kick in unless paused.

Trump-Xi Summit: Still possible in South Korea or Washington (Oct 20); Bessent hints at extensions for rare earth delays.

Risks: Full embargo could slash bilateral trade 50%+; WTO challenges mounting (US IEEPA use ruled illegal but appealed). China eyes “global governance” pivot (e.g., BRICS trade).

Outlook: No quick resolution; experts predict prolonged “cold war” with selective thaws. Trump views it as leverage for manufacturing revival; Beijing as defense of sovereignty.

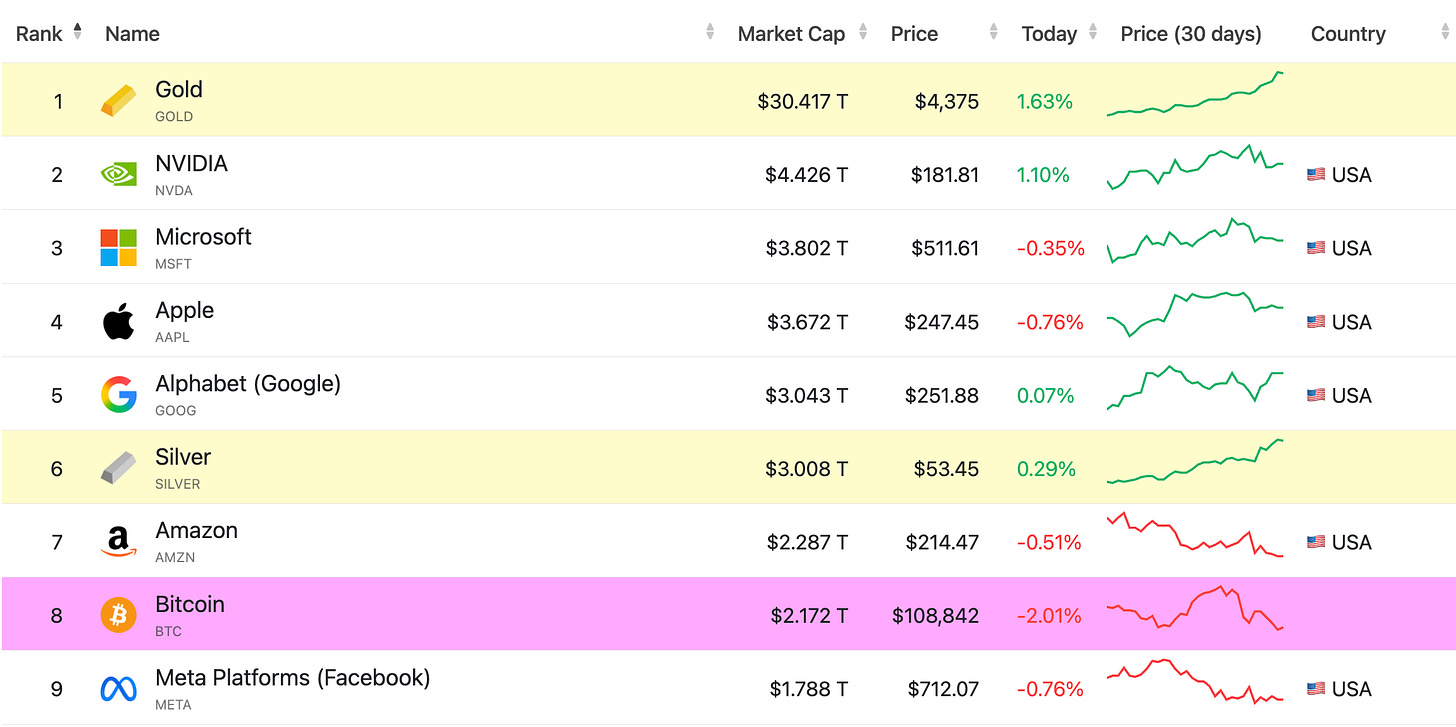

🥇 Gold Becomes the First Asset to Hit $30 Trillion

The tariff drama has spooked markets and reignited the old-school safe-haven play. With global uncertainty soaring, Gold and Silver are FLYING.

Gold Rush: Gold futures hit $4,280.20 on Oct 16, up 2.47% intraday, driven by trade fears and an 85% chance of a Fed rate cut next month. Tariffs alone added a ~$200/oz premium since September.

Silver Stuns: Silver hit $51.70 on Oct 13 — its first all-time high in 45 years — fueled by a short squeeze and supply fears from tariff-hit mining and electronics sectors. Up 73% YTD vs. gold’s 45%.

Dollar Down: The DXY has dropped 10% since Trump took office on Jan 20, 2025. As faith in the USD slips, capital is pouring into gold, silver, and somewhat Bitcoin.

If Trump and Xi manage a truce, expect a pullback. But if tariffs go full send, gold could hit $4,500+, silver $60+.

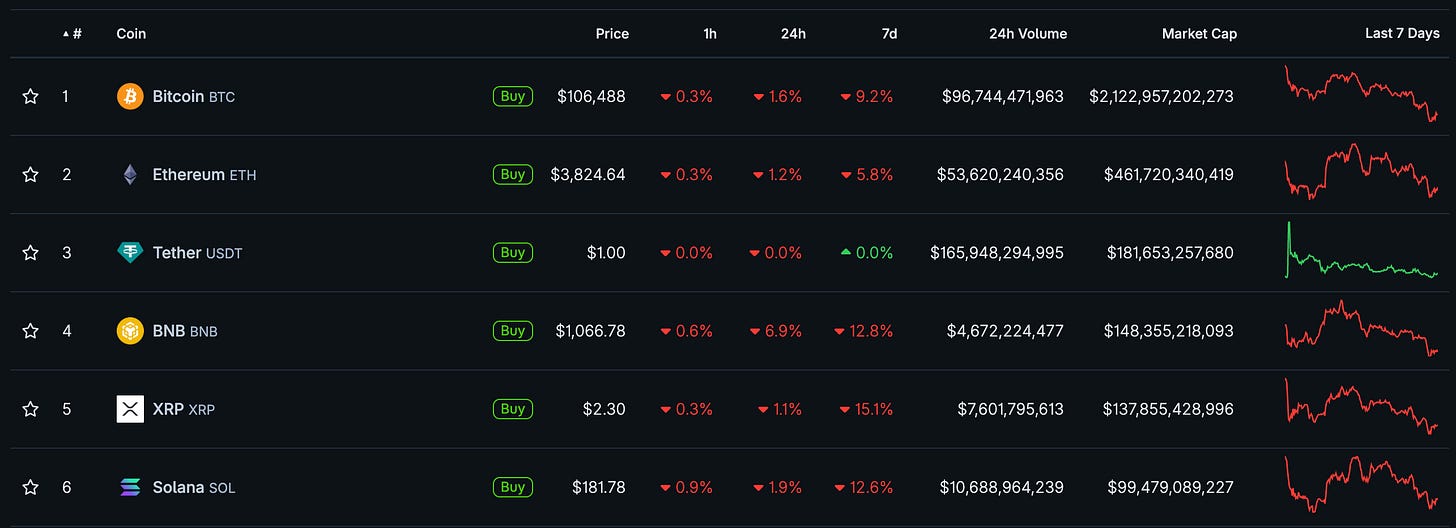

Crypto liquidations and lessons

Crypto got caught in the crossfire. Last Friday’s flash crash saw nearly all leverage wiped clean.

And after markets somewhat recovered earlier this week, the market is once again visiting the lows of last Friday.

“Oh, you thought you bought the dip?? Think again.” - Market Makers

While some are calling this the end of the cycle, we believe it looks more like another shakeout. This entire cycle, crypto has repeated the pattern ‘three steps forward, two steps back’. Between entering late-longs and borrowing fees, leverage traders have been wrung dry.

As we’ve said before, this cycle will be led by institutional investments. BTC, ETH and SOL have made the biggest headway on Wall St., and will lead the charge back.

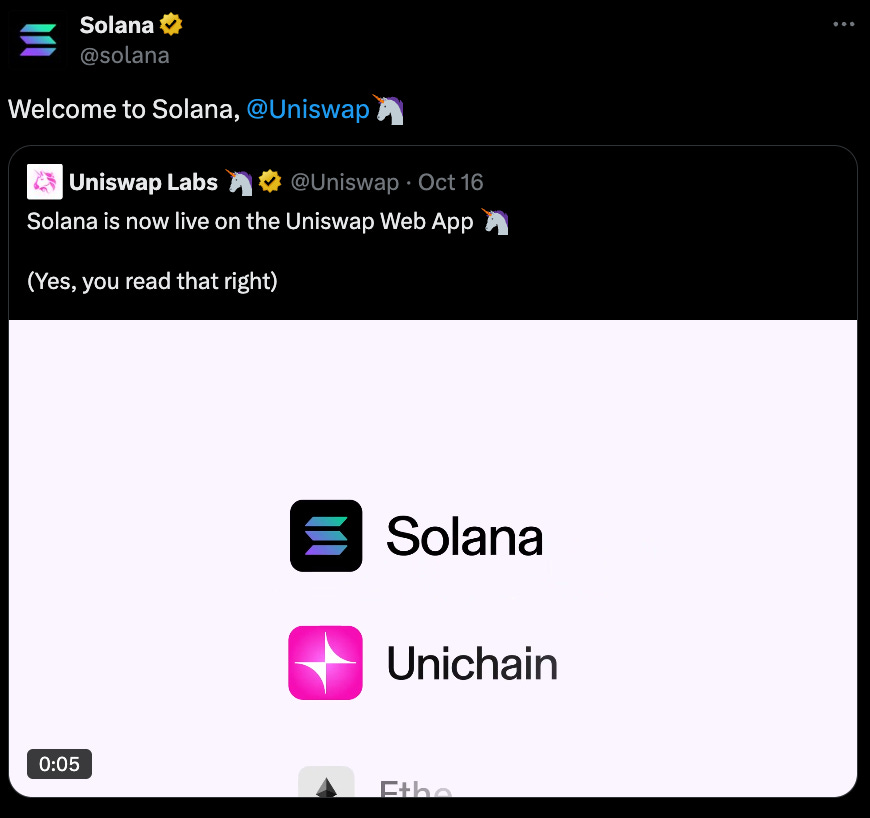

Solana News

Uniswap, the leading decentralized exchange (DEX) primarily built on Ethereum, has officially integrated Solana support into its web app. This marks Uniswap’s first major foray into a non-EVM chain, aiming to bridge fragmented DeFi ecosystems and tap into Solana’s high-speed, low-cost environment.

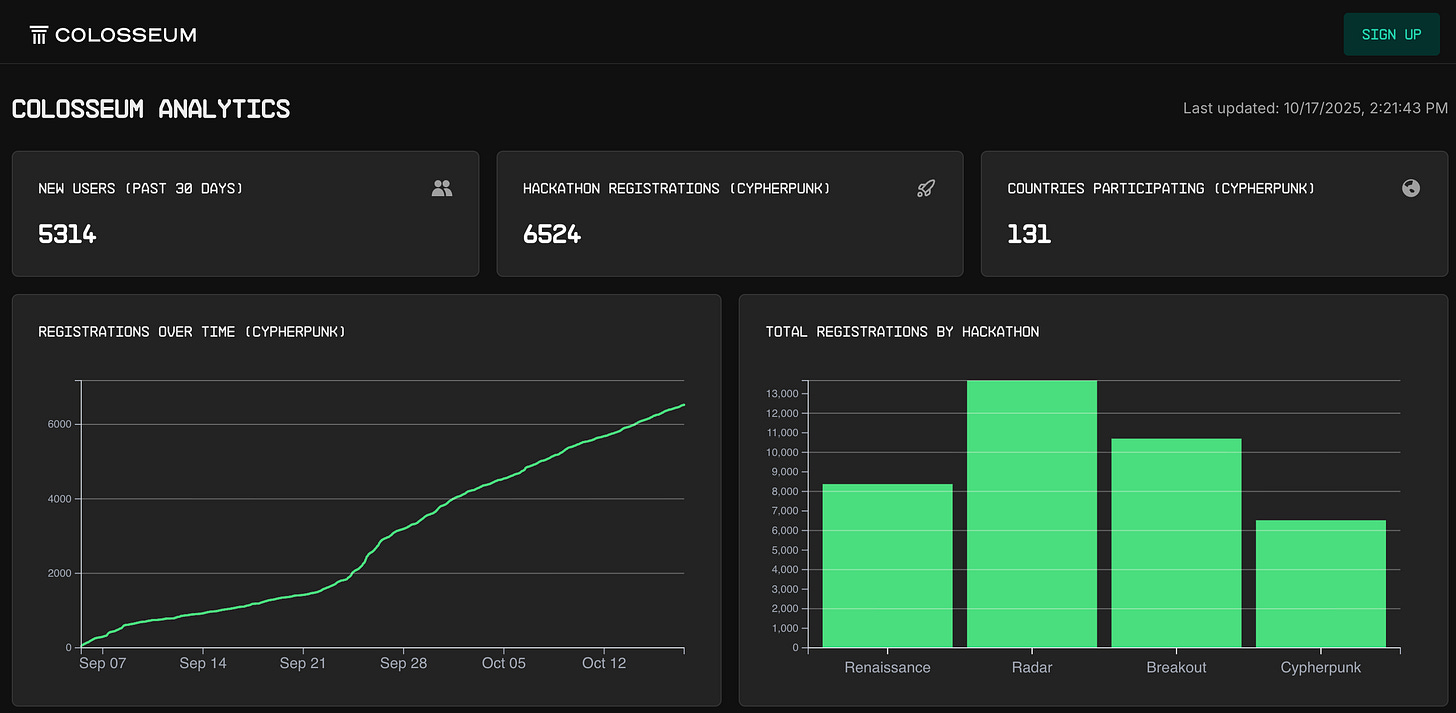

The Colosseum Start-up Accelerator publishes participant stats. Check them out here.

Meteora, the 3rd largest DEX on Solana, has launched its MET token airdrop checker ahead of the token generation event (TGE) on October 23, 2025. This is poised to be one of Solana’s largest airdrops, with pre-market valuations hitting $1.08 billion and individual allocations rewarding early liquidity providers (LPs), beta testers, and community contributors.

Z-cash (ZEC), the privacy-focused cryptocurrency known for its shielded transactions, has launched on Solana via the “Zolana Bridge,” enabling seamless bridging and trading of ZEC tokens on the network.

Vybe Updates

SolanaFloor just published a deep dive on how to use Vybe to find and copy the best-performing wallets. Read here.

Did you know there is over $700M in unclaimed MEV rewards and dust tokens?

👉 Check for unclaimed $SOL on Vybe.

Final Thoughts

Gold’s shining, tariffs are climbing, and crypto’s reminding everyone that leverage is one hell of a drug.

That being said, crypto markets move fast and we believe now is not the time to be sidelined.

See you next week, Vybe Tribe. 🫡

-Vybe Intern