UPTOBER → REKTOBER: Gov't shutdown sends Bitcoin to new ATH's before new China tariffs crash the party. 💀

Market Vybe #23

Good afternoon Crypto Enthusiasts,

I was halfway through writing this week’s piece before the markets decided to play an Uno reverse card and send prices into the netherworld. So instead, let’s dig into whether the cycle might actually be over, and why this time.. it might truly be different.

The Setup

Historically, October and November are two of the strongest months for crypto. Just last week, Bitcoin hit a new all-time high of $126,000, Solana touched $235, and for the first time ever, total crypto market cap crossed $4.2 trillion.

Ironically, crypto ripped higher during the same week the U.S. government shut down. As strange as it sounds, shutdowns have historically been bullish for risk assets.

The Perfect Storm

So what caused this sudden nuke? A few factors collided at once:

Trump’s Tariff Bombshell

This afternoon, Donald Trump announced a 100% tariff on all Chinese goods, on top of existing tariffs. That effectively froze global trade expectations overnight. The timing made things worse since it came on a Friday afternoon when institutions typically risk-off going into the weekend and markets are illiquid.Equity Market Euphoria

Stocks were showing clear signs of froth. AI and tech names were on a tear with stretched valuations and euphoric sentiment. ChatGPT’s new partnership with AMD added $100B to their market cap overnight. Wall St. favorites like HOOD, PLTR, and COIN were seeing 2–5% daily gains like it was normal price action. It’s not.Rumoured Trading Desk Blowups

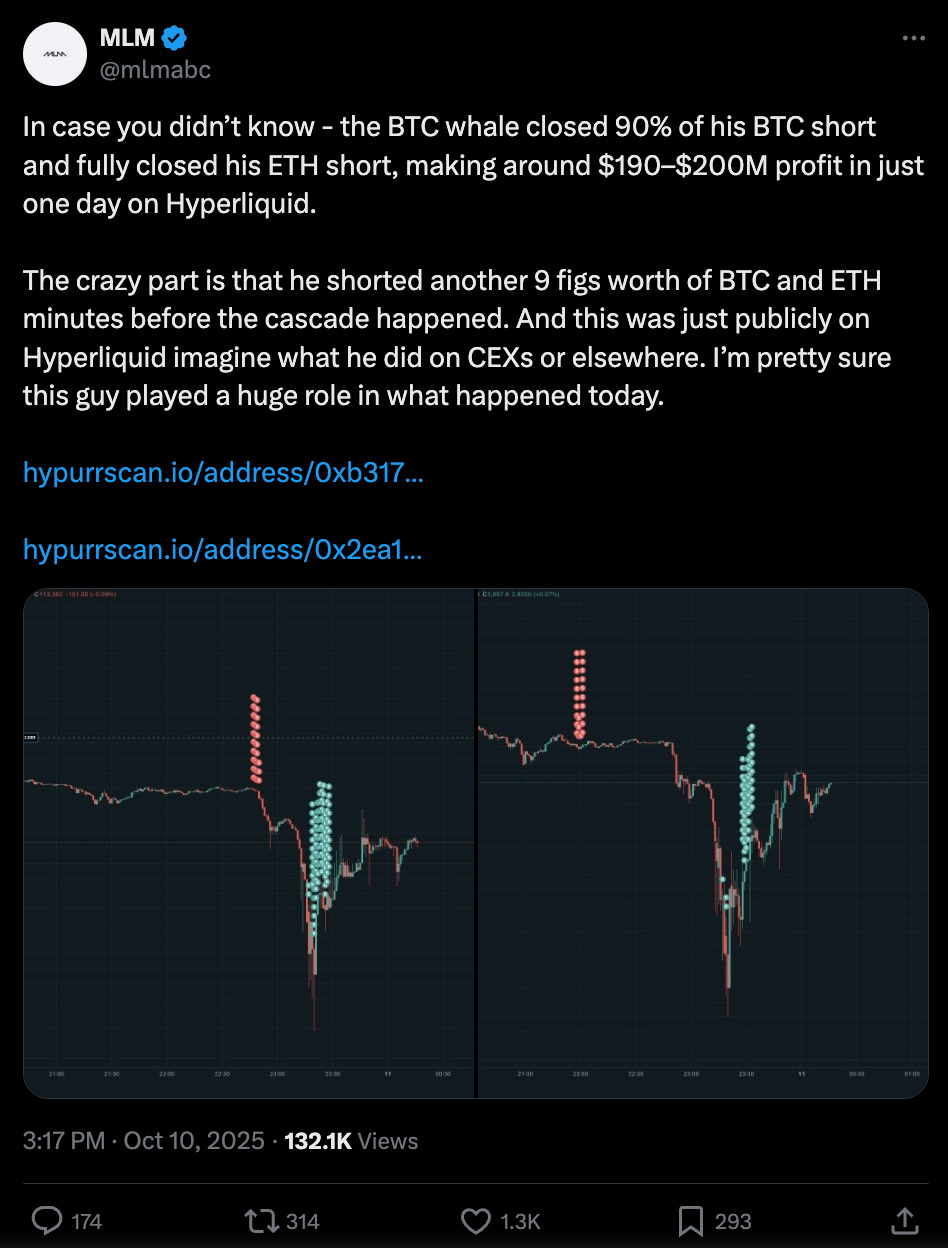

Over $6 billion in liquidations hit within an hour. That doesn’t happen without casualties. Rumours are swirling that a certain market maker got wiped out.Potential Foul Play

One anonymous whale reportedly dropped a perfectly timed $100M short on Hyperliquid just minutes before the tariff announcement. You can draw your own conclusions.

Unironicaly, this dip might have marked the local bottom for crypto markets. Generally, the initial shock of the news front runs the real impact of putting tariffs into place.

It’s probably too early to determine anything, but as Warren Buffet once said “Scared money don’t make money.”

The 4-Year Cycle and Why It’s Fading

Bitcoin’s price cycles have long been tied to its halving events, which happen roughly every four years. Historically, it’s taken about 1,050 to 1,070 days from cycle bottom to cycle top.

The 2022 bottom after the FTX crash to the projected top in October 2025 (today) lines up almost perfectly with that timeline. But this time, several factors suggest the traditional model might be breaking down.

1. Diminishing Halving Impact

Each halving now has a smaller relative effect. Going from 12 to 6 BTC per block was massive. Going from 3 to 1.5 BTC? Not so much.

2. The Interest Rate Shift

Past crypto cycles played out in a near-zero-rate world. This one saw rates spike to 5% and only now trending lower. As liquidity returns, risk assets like crypto attract flows again.

3. The Institutional Era

Unlike retail-driven cycles of the past, this one’s been powered by institutions like BlackRock, Fidelity, and corporate treasuries stacking BTC. Institutional buyers are less likely to panic-sell. That dampens volatility but also changes cycle psychology.

The Financial Awakening

People are waking up to the depreciating nature of fiat. Governments keep choosing easy money over fiscal responsibility, expanding the money supply instead of addressing debt.

Even now, as the U.S. faces a shutdown, everyone knows how this ends: with a bigger budget and more liquidity entering the system. As a result, Gold just broke $4,000 for the first time ever. If Bitcoin really is digital gold, then its upside remains enormous.

Global Liquidity, M2, continues to march higher showing no signs of slowing down.

Vybe Updates

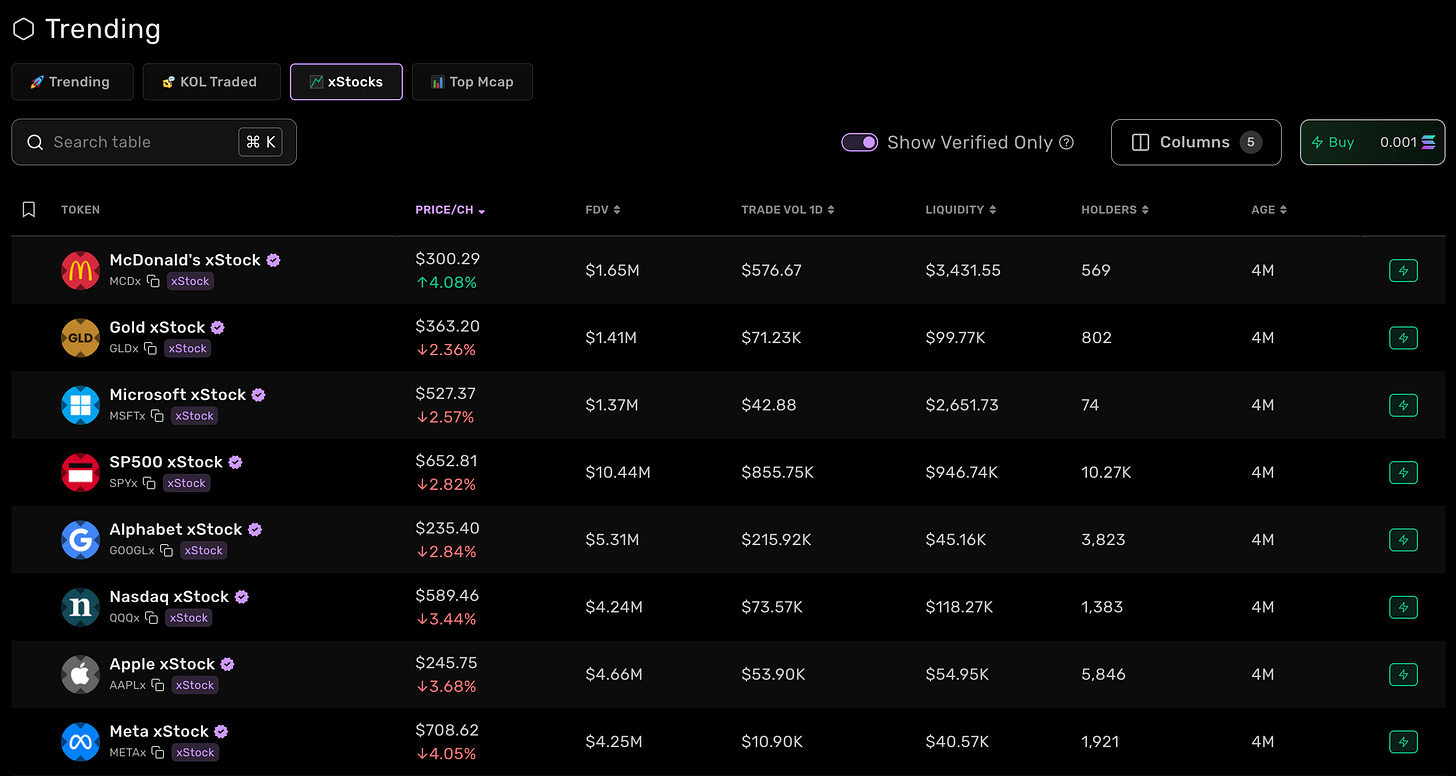

We’ve added xStocks to our token tables. You can now discover and track tokenized stocks directly on Vybe.FYI.

We’ve also rolled out quick buys, so you can trade tokens right from the table without leaving the site.

We’ve got plenty more updates on the way, including a brand-new trading terminal that’s guaranteed to blow your mind.

And if you haven’t checked your wallet for rent fees or burnable tokens lately, you might be sitting on some hidden $SOL without even realizing it.

You can reclaim it in seconds right here 👉 Vybe.FYI

Final Thoughts

We don’t believe this is the end of crypto cycles, but we do believe the game has changed.

Institutional flows, global macro policy, and liquidity mechanics now drive crypto far more than retail emotion. The asymmetric, lottery-style gains might be behind us, but a new era of long-term, structural adoption is here.

As the asset class matures, it’s becoming less about gambling and more about generational wealth. In other words, just keep stacking.

If you’re Canadian, have a wonderful thanksgiving, and I’ll see you next week!

-Vybe Intern