Market Vybe Issue #4

Will a weaker dollar propel crypto to all time highs

👉Weekly Recap

WHAT IF I TOLD YOU..

That Trump’s chaotic and unpredictable behaviour, during his first 3 weeks in office, was not only intentional, but will result in your crypto holdings reaching incredible new all-time-highs.

Hard to believe?

Let’s examine 2017 — Trump’s first year in office. Similar to today, we entered his first presidency with a strong dollar. The DXY (dollar strength index) was hitting decade highs, making trade with foreign countries difficult.

A strong dollar makes U.S. exports pricier and imports cheaper that can potentially cause trade imbalances and deficits.

In his words:

It's very, very hard to compete when you have a strong dollar and other countries are devaluing their currency. - Donald Trump (April, 2017)

Trumps solution to the trade imbalance was to implement tariffs.

This motivated some countries to retaliate with their own tariffs, while also reducing global demand for dollars. To put it simply, if importing a good from a foreign country becomes more expensive than making it locally, than they will make it locally.

All of this chaos made some investors hedge away from the dollar, favouring assets that stood to gain from a weaker greenback—like U.S. equities.

As the DXY fell, major stock indices (and bitcoin) shot up, illustrating the inverse relationship between the value of the dollar and risk assets.

Here were the returns for 2017:

Entering 2025, the US Dollar was at multi-decade highs.

And just like in 2017, Trump has instigated new trade wars turning global trade on its head.

Alongside the expected rate cuts, it’s likely the DXY loses momentum and with nowhere else to go, we believe this could herald a return back to risk assets.

Maybe we’re just wearing rose-colored glasses, but the parallels to Trump’s early 2017 moves are giving us serious déjà vu.

SOLANA NEWS

Have Binance listings become a ‘sell the news’ event? New projects that have been listed in 2025 haven’t done great.

Sol Strategies (HODL) recently acquired an additional 24,374 SOL increasing their total holdings to approximately 214,342 SOL.

Solayer’s $LAYER airdrop went live today (Feb 11th). Solayer is a restaking platform on Solana aimed at enhancing security and infrastructure.

At launch, there was an initial selling pressure, but seems to be subsiding as more buy volumes starts entering at these levels $0.75-$0.80

Dive into $Layer metrics on Vybe: Here

MEMECOIN MADNESS

ENRON - Someone purchased Enron’s trademarks for $275 (why was it so cheap?!?), and relaunched it as a memecoin.

CAR - Central african republic launched a memecoin. It ran up to $850M in under 6 hours. As of writing this article, it’s retraced below $50M (owie).

JAILSTOOL - Barstool Sports president Dave Portney CTO’d a coin. He managed to get it listed on Kraken, before having a public crashout because people were not holding.

* Visit links in token names above for more metrics on these tokens

👉 Alpha of the Week

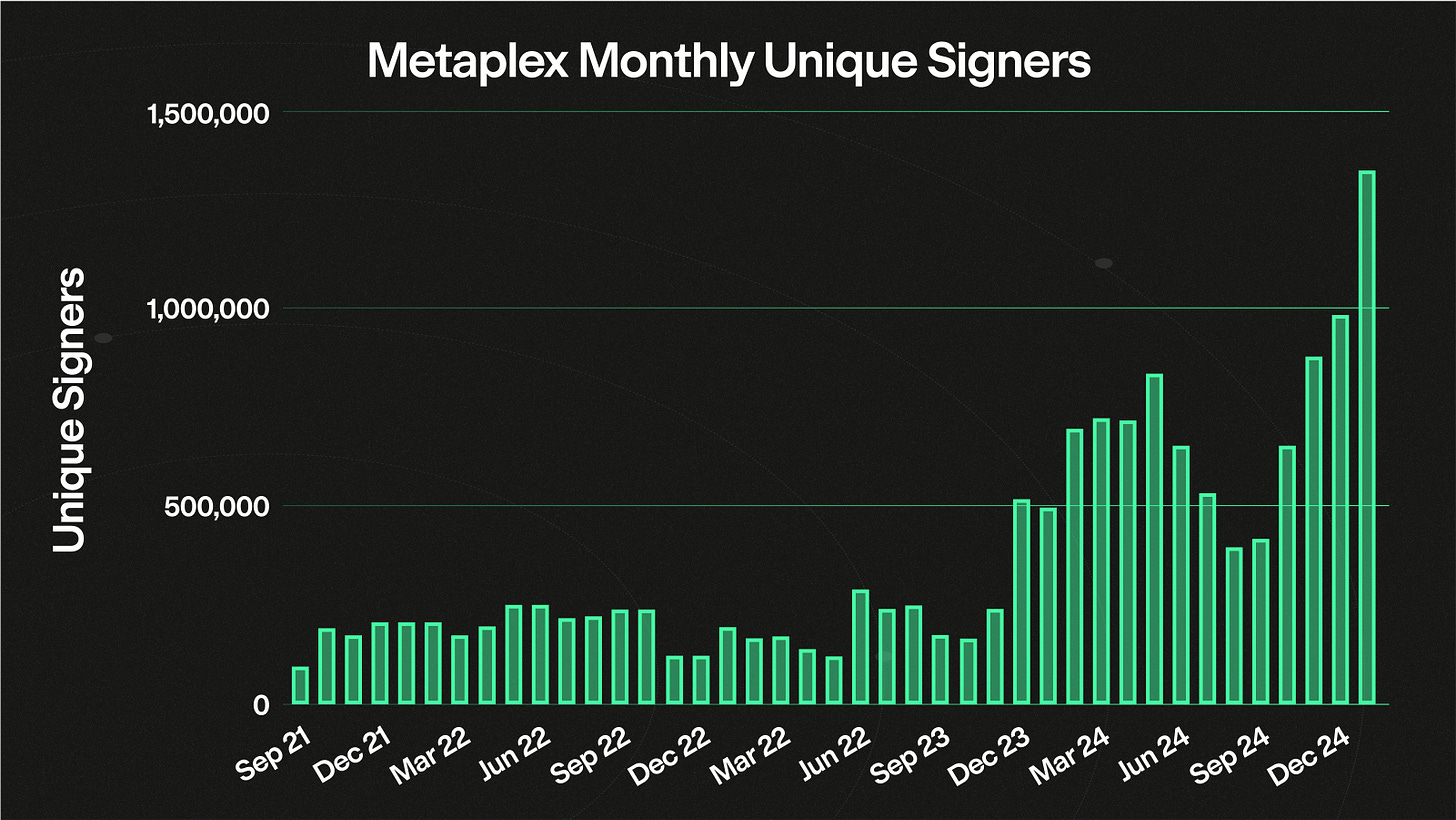

In January, Metaplex achieved an all-time high by facilitating the creation of over 12 million fungible tokens and saw 1.9 million Token Metadata assets minted, the highest monthly total ever.

The protocol also saw a record 1.35 million unique wallets interacting with it, marking a 38% increase month-over-month.

Additionally, Metaplex generated over $4.3 million in protocol fees, which were partially used to buy back 9.2 million MPLX tokens for the Metaplex DAO. Is this the next billion dollar FDV token on Solana? 🤔

👉 Vybe Announcements

Vybe API V2 launches on Feb 12th!

We’ve revamped our APIs to allow you to build faster, smarter, and more endpoints that opens up new use cases based on popular demand!

Some key changes over V1:

Faster RPM

Advanced endpoints

Improved credit rate limits

If you’re building a new dApp or want to add new features to your protocol, contact us to learn how Vybe can help you build on Solana faster, cheaper and smarter.

For more details visit our docs here - VYBE API V2