Market Vybe Issue #3

Did you buy the dip, Anon?

👉Weekly Recap

Market resets are part of the game.

In previous bull-runs, we saw multiple 30%, 40%, 50% pullbacks on the climb up. Although the short term prices can be discouraging, we’re witnessing the most crypto-friendly administration in history. With the upcoming Solana ETFs, traditional finance is making it easier for retail to buy in, a potential national crypto stockpile and the SEC acknowledging that banks can safely accept crypto.. There are a lot of positive tailwinds that will send prices higher in the long run. We believe that the diamond handed Chads that can DCA into huge red days, like this past Sunday, will be rewarded in the end.

The Madman actually did it.

On Sunday, Trump planned to impose tariffs of up to 25% on both Mexico and Canada, as well a 10% tariff on goods from China.

This sent shockwaves through global markets. Investors were scrambling as these measures, aimed at protecting US domestic industries (and allegedly to incentivize better border control), instead sparked fears of a broader trade war.

Bitcoin retraced back to 93K, Solana bottomed at $181, while Ethereum NUKED to $2,000. The volatile price action triggered a record $10 billion wave of liquidations over a 24 hour period.

Rumours are circulating that a crypto hedge fund got obliterated by recent market volatility, potentially contributing to Ethereum’s price cascading.

That being said, as of writing this newsletter, significant progress has been made towards resolving things. Both Mexico and Canada have made compromises to delay the tariffs for at least 30 days.

Only 48 hrs after launching trade wars with 2 of America’s closest allies, Trump has walked away with some modest wins. In our opinion, it’s clear that the tariffs are being used as a political bargaining chip, and not as a serious source of long term income.

Trump is aware that tariffs will import inflation, making it harder to lower interest rates. As a businessman, and a developer, he understands, as good as anyone, lowering interest rates will usher in the golden bull run for both stocks and crypto.

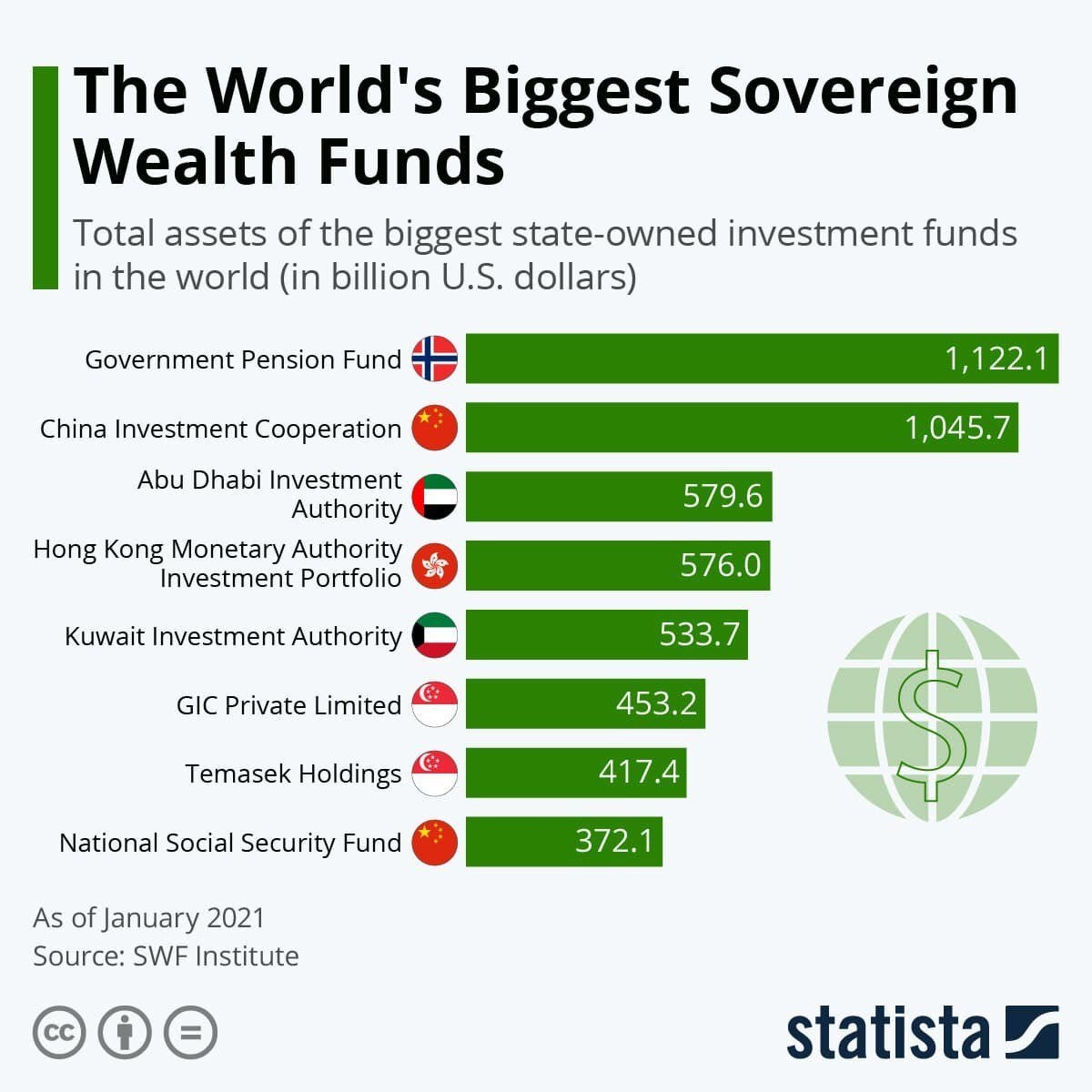

The Market did receive one more surprise. On Monday, Trump ordered the creation of a US sovereign wealth fund.

What is a Sovereign Wealth Fund?

A sovereign wealth fund is essentially a pool of money owned by the government, derived from various sources like budget surpluses, foreign currency operations, or revenue from natural resources. These funds are used to invest in various financial assets globally to achieve returns or strategic goals.

The US SWF, if approved, will join a number of other countries like China and Saudi Arabia, in the quest for ROI.

Senator Cynthia Lummis has slyly hinted that this might be National Crypto Stockpile we’re all looking for.

👉 Alpha of the Week

Jupiter is on FIRE

Jupiter, a major decentralized exchange and liquidity aggregator on the Solana, recently announced a $3 billion token burn 🔥

Alongside this, they've introduced a buyback program where 50% of the platform's fee revenue will be used to repurchase JUP tokens from the market.

Jupiter also recently acquired Moonshot, a popular mobile trading app that recently onboarded over 1,000,000 new traders with the launch of $TRUMP token.

The JUP team are quickly becoming a powerful force in the crypto space with multiple revenue streams. Some are saying it’s reminiscent of the early days of Binance. 👀

More JUP Perps analytics here on Vybe.

👉 Vybe Announcements

1- Vybe Validator Updates

As mentioned in last weeks newsletter, Vybe validator has secured over 120,000 staked sol and continues to grow due to it’s high yield and performance. Current yield estimates are at almost 11% APY that includes MEV rewards.

However, this is only the first step into bringing more value to the Vybe community. Staking directly to the Vybe validator will soon grant access to Vybe pro, which are upcoming premium features on the Vybe app – The intelligence platform and most advanced wallet/portfolio solution on Solana.

Vybe Pro will only be available to users’ staking SOL with Vybe. Launch is tentatively planned for Q2 of 2025. More details to come on these features, including plans on how we’ll reward early users who stake with us.

Make sure to follow us on Twitter/X on latest announcements.