Market Vybe #9

Morning Routine ~ Check price, good price

👉 Weekly Recap

Last week’s headlines were dominated by one of the most significant FOMC meetings in recent history, and for now, it seems the bulls have emerged on top. We also saw a surge of positive news within the Solana ecosystem, including several major players expanding onto the network. And don’t forget—our Vybe Telegram Bot Challenge, with $5,000 in cash prizes, is now LIVE!

Lets dive in.

The economic backdrop is continuing to show signs of improvement.

At the FOMC meeting on March 19, 2025, the Fed maintained its benchmark interest rate at 4.25%–4.5%, a move that was widely expected by the market.

Pro Tip: The CME Group has a tool called fedwatch that shows the probabilities of FOMC rate moves.

Fed Chair Jerome Powell's comments, along with the updated economic projections, conveyed a cautious yet slightly dovish message, citing "remarkably high uncertainty" due to the effects of the Trump administrations policies such as tariffs.

Additionally, the Fed announced it would slow the pace of quantitative tightening (QT) starting April 1, 2025, reducing the monthly cap on treasury securities runoff from $25 billion to $5 billion. This follows a previous adjustment in June 2024, when the cap was lowered from $60 billion to $25 billion. To put it simply, when QT ends, QE begins (A.K.A. money printer goes brrr).

As a result, Bitcoin is up 4.5% and Solana is up 12% in the past 7 days. While we’re hesitant to declare the market dip over, we’ll take what we can get. 😂😂😐

👉 Solana News

Pump.fun’s new DEX, PumpSwap, is crushing it. They just hit $454M in trading volume, 243K users, and $1.064M in fees in the past 24 hours. It now accounts for 14% of ALL trading volume on Solana (and it’s still climbing). 👇

A market reset brings fresh memes: Morning Routine, is probably one of the funniest memes we’ve seen in a while and it might have just saved the trench’s.

Solana Futures ETFs Launch: Last week saw the debut of Solana futures ETFs on the CME Group and Nasdaq, with offerings like the Volatility Shares Solana ETF (SOLZ) and the leveraged 2X Solana ETF (SOLT).

Blackrock’s BUIDL fund expands to Solana after debuting on Ethereum last year. The fund holds $1.7 billion in cash and U.S. Treasuries, with expectations to hit $2 billion by April.

Polymarket announces their expansion onto Solana.

Fidelity files for a spot Solana Fund in Delaware: Fidelity has over $5 trillion in assets under management and currently offers BTC and ETH spot ETFs.

Remora Markets, an RWA exchange on Solana, opens KYB applications to onboard businesses.

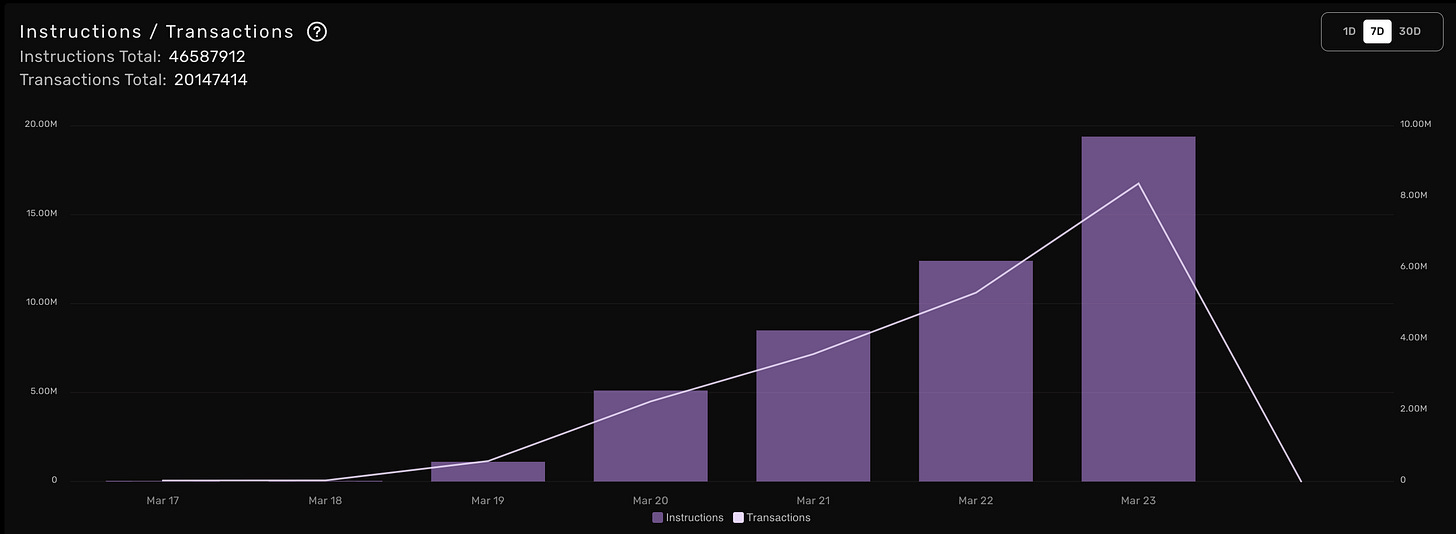

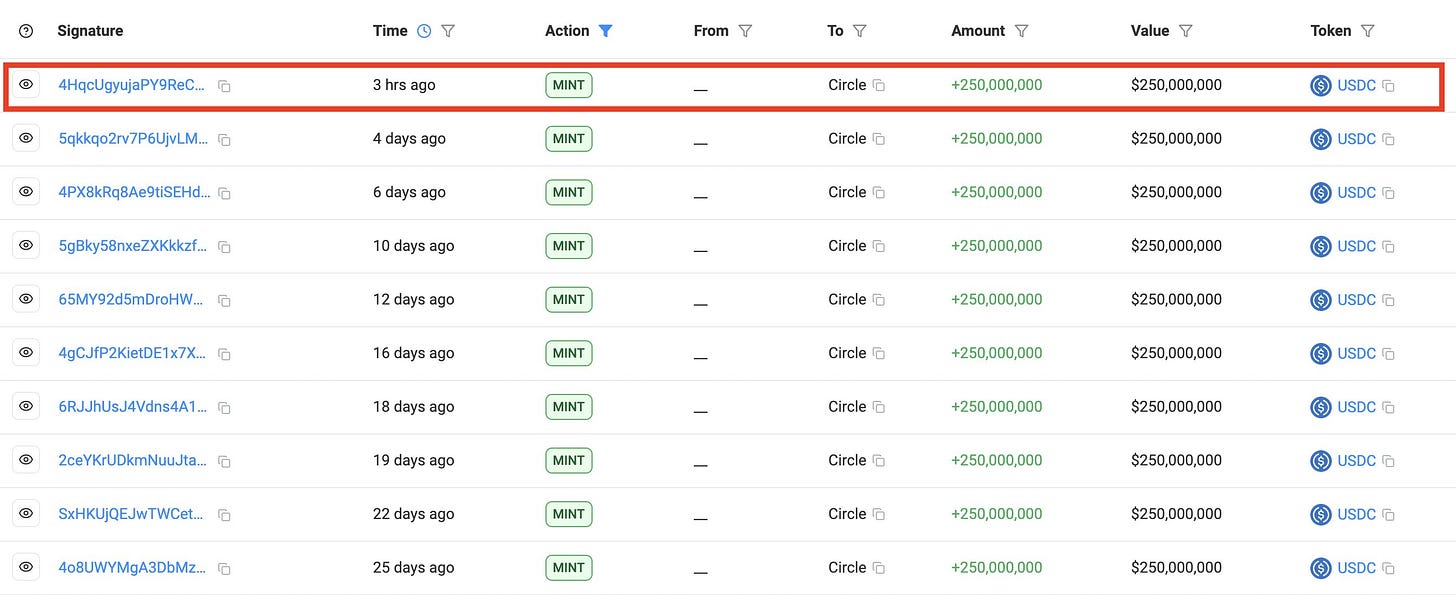

Circle mints another 250M on Solana: This brings the total USDC minted on-chain to $10.75B.

👉 Alpha of the Week

New Solana DEX, Titan, gives better prices than Jupiter 80% of the time.

The Titan Exchange is a new DEX aggregator on Solana. It features a proprietary routing algorithm named Talos, designed to optimize trade execution by sourcing quotes from multiple aggregators, including its own, to secure the best possible prices for users.

Launched privately around March 20, 2025, Titan claims to outperform Jupiter, the leading DEX aggregator on Solana, with 80% of swaps, according to statements from its CEO, Chris Chung, and early user feedback.

While still in its mainnet beta phase, Titan aims to challenge Jupiter’s dominance by focusing on superior pricing, though it currently lacks some of Jupiter’s broader features like perps or limit orders. This emerging competition could drive innovation and better outcomes for Solana traders seeking cost-efficient swaps.

Jupiter’s reputation recently took a hit after their co-founder, Ben Chow, stepped down for his involvement in $LIBRA, $MELANIA and other memecoin scandals.

Furthermore, JUP holders recently expressed concerns over a vote that would have significantly increased the circulating JUP supply by paying 120,000 JUP per month to each of 65 new team members as bonuses. That’s in addition to their USDC salaries. These recent missteps could create an opening for a new leading DEX aggregator.

👉 Vybe Announcements

The [REDACTED] hackathon is now live! As sponsors, we're excited to present the Vybe Telegram Bot Challenge.

What you need to do:

Goal: Create a functional Telegram bot using Vybe APIs for actionable, real-time crypto insights, linking users to AlphaVybe for deeper analytics. Innovate beyond PhanesBot with unique features!

Deliverable: Fully operational Telegram bot with complete documentation.

What’s up for grabs?

1st prize: $3000

2nd prize: $1500

3rd prize: $500

We're less than 30 days away from the launch of Vybe V2! To unlock full access to the powerful analytics and trading tools we've developed, you'll need to hold some VybeSOL. With an APY of around 8.2%, you can start earning today!