Market Vybe #7

Is this market manipulation?

👉Weekly Recap

It’s been another chaotic week in crypto. One minute we’re staring into the abyss, muttering “it’s over,” and the next we’re popping champagne, shouting “we’re so back.” Here’s everything you need to know

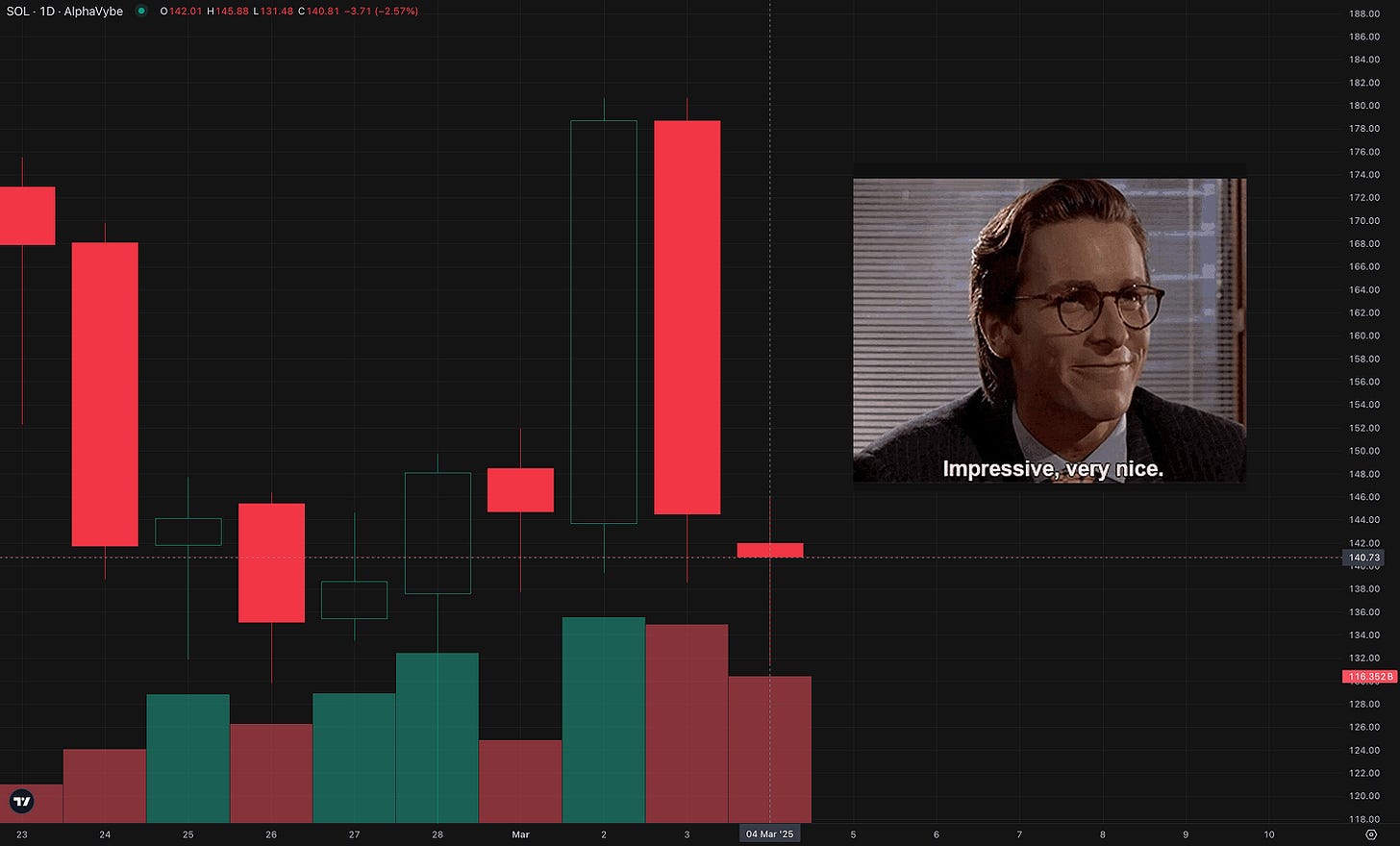

Last week, Bitcoin took a brutal tumble, cracking support between $90K-$88K and bottoming out at $78K by Friday night. Solana also got hit hard, tumbling from $180 → $140 in 2 days.

The Fear and Greed Index plummeted to 11—a level unseen since the FTX collapse in July 2022. Panic set in, but the weird part? No one could pinpoint why.

Was it Bybit clawing back losses through mass liquidations? Or did the $1.7 billion Solana (SOL) unlock on March 1st, spook the herd?

Then, on Sunday morning, Trump dropped a bombshell on X, announcing plans for a U.S. Strategic Crypto Reserve. To many people’s surprise, it included not just Bitcoin, but Ethereum, Solana, Cardano and XRP.

The market went crazy with double-digit gains across the board.

BTC +15%

ETH +20%

XRP +30%

SOL +30%

ADA +70%

Unfortunately, the euphoria didn’t last.

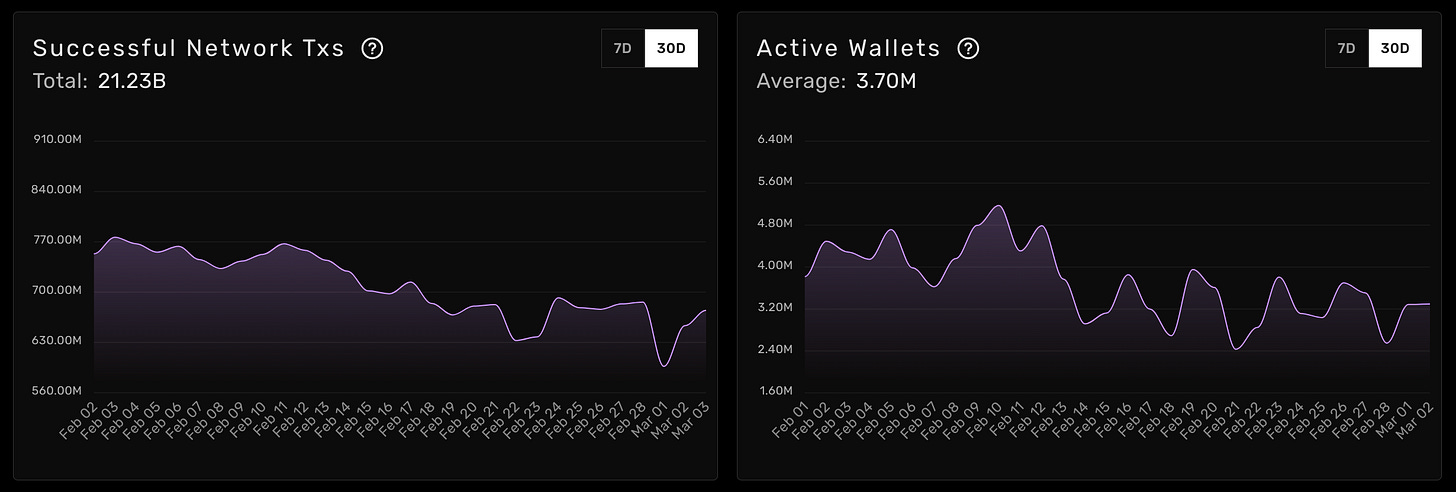

Trump’s announcement wasn’t universally cheered on. Industry heavyweights like Brian Armstrong and the Winklevoss twins raised eyebrows at the inclusion of non-Bitcoin assets. ZachXBT didn’t mince words, slamming $XRP and $ADA as “ghost chains” with minimal activity.

Meanwhile, Arthur Hayes poured cold water on the whole thing, noting that without congressional approval, it’s just an empty promise.

By Monday afternoon, the market had retraced the entire move.

Still, hope remains.

This Friday marks the first ever White House Crypto Summit. Word is, we’ll get the full scoop on the reserve’s investment strategy and how it’ll be funded. In addition, rumors of crypto tax clarity are floating around.

Insider Trading or just a Degen?

Now, here’s where it gets juicy. Hours before Trump’s tweet, a mystery whale dropped $200M on 50x leveraged longs for BTC and ETH on Hyperliquid.

Risky? more like insane.

A $50 dip in ETH or a $150 slide in BTC would’ve instantly burned $5M.

Instead, Trump tweeted, the market mooned, and the whale cashed out a cool $6.8M profit. Coincidence? Insider info? You decide—either way, it’s sus.

UPDATE: They also made money shorting bitcoin on the way down.

More Solana News

CME Group’s Solana Futures: On February 28, 2025, CME Group, the world’s largest derivatives marketplace, revealed plans to launch Solana futures contracts on March 17, pending regulatory approval.

Ship or Die Hackathon in NY: The Solana Foundation’s "Ship or Die" event, set for May 19-23, 2025, in New York City, features "Scale or Die," a builder-focused hackathon on May 19-20, followed by a crypto conference, spotlighting rapid innovation across seven tracks.

Solana’s DEX volume hit $105.857 billion in February 2025, beating Binance Smart Chain and Ethereum for the sixth month running since September 2024.

Colosseum, a Solana accelerator, invested in Dev.fun, a developer-focused offshoot of Pump.fun, likely in late February 2025.

GoFundMemes will now pair with JitoSOL instead of SOL for liquidity pools. JitoSOL, auto-compounds staking rewards (around 7-8% APY) and includes MEV (Maximal Extractable Value) profits, potentially boosting returns for liquidity providers.

👉 Alpha of the Week

Bitcoin’s price has shown a strong historical correlation with global liquidity, often acting as a barometer for the availability of money in the global financial system.

Research indicates that Bitcoin moves in the same direction as global M2 money supply—cash, checking deposits, and near-money assets—83% of the time over a 12-month period, more than any other major asset class. Typically, Bitcoin’s price lags behind shifts in global liquidity by about 8 to 12 weeks.

This recent dip coincides with the down trend from Dec-Jan. However, with Global liquidity picking up again, could this reignite the bull-run? This is definitely worth watching.

👉 Vybe Announcements

Vybe Validator Update

The Vybe Validator has now been live for 3 months and boasts a 0% skip rate with consistent 100% uptime after the initial launch in December. We’ve implemented strategies to eliminate downtime during upgrades and transitions—take our seamless move from the Agave client to Jito as proof, with no skipped slots. We’ve also successfully deployed the Firedancer client on testnet with no issues.

In other news, we have a special announcement about VybeSOL coming very soon! Stay tuned for our upcoming article with all the details and make sure to follow us on Twitter/X.