Market Vybe #6

The great capital rotation - memecoins ➡️ utility

Join our new Vybe telegram channel for exclusive alpha, trading insights, and special merch drops!

👉Weekly Recap

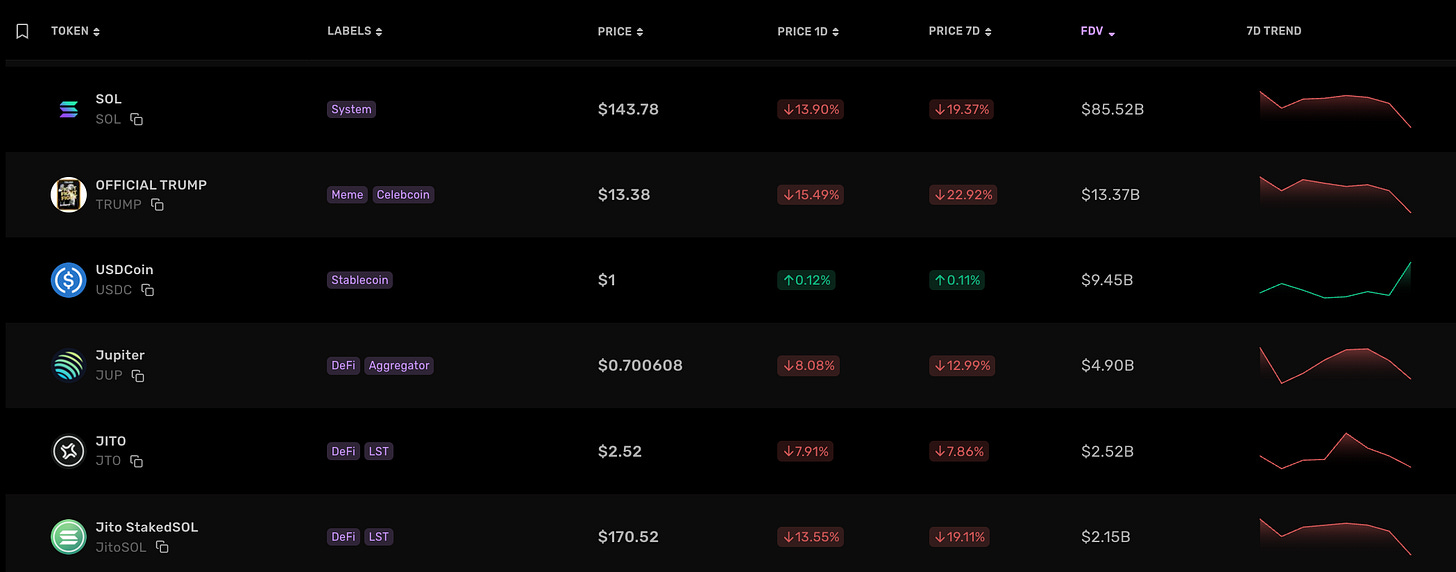

MARKET UPDATE

It’s been another WILD week in the crypto. Just when things were starting to look OKAY, the third-largest crypto exchange, Bybit, suffered a historic $1.4 billion hack at the hands of North Korea’s Lazarus group. The sheer scale of the attack raises disturbing questions about both its execution and the financial contagion that could follow. Meanwhile, Solana is bracing for a final major token unlock, leaving investors on edge.

Adding to the drama, the infamous “LA Vape cabal” has gone conspicuously silent in the aftermath of Libra’s downfall, and Solana’s “daily runner” memecoin pumps have all but dried up. If you’re ready for some hot takes, let’s dive in.

BLOODY MONDAY

Trump spooked the markets on Monday after reiterating his commitment tariffing Mexico and Canada. There has been over $1.48 Billion in liquidations over the past 24 hours.

The fear and greed index is now at ‘Extreme Fear’.

This flush was likely driven by big players helping bail out Bybit. in the past 24 hours, Wintermute withdrew and sold 10’s of millions of BTC, ETH and SOL, triggering a cascade of liquidations.

THE BYBIT HACK

On February 21, 2025, Bybit, a major crypto exchange based in Dubai, suffered a historic security breach, resulting in the theft of approximately $1.4 billion worth of Ethereum.

The attackers employed a sophisticated method, manipulating the user interface (UI) during a routine transfer from an offline cold wallet to an online warm wallet. Around 401,346 ETH was stolen and subsequently moved to multiple addresses.

Bybit’s CEO, Ben Zhou, quickly took to x to confirm the breach and to reassure users that the exchange remains solvent. Ben stated that client assets are backed 1:1, and that it could cover the loss through reserves and an emergency bridge loan from ecosystem partners.

Regardless, news of the hack triggered a massive surge in withdrawals, with over $4 billion in outflows processed by Bybit. Blockchain analysts, Elliptic and ZachXBT, linked the attack to North Korea’s Lazarus Group, a state-sponsored hacking collective known for previous high-profile crypto thefts.

Currently, the stolen funds are being laundered through various services, however Bybit and the crypto community have done a commendable job of tracking funds and blacklisting wallets.

This incident exposed vulnerabilities in multi-sig cold wallet security, particularly the human element, as social engineering and UI manipulation bypassed the technical safeguards. It’s still not conclusive whether:

Bybits computers had malware installed,

the UI for safe.eth, the multi-sig provider, was compromised,

the ledger hardware used to sign the tx was compromised,

or, there is a Lazarus team member working undercover at bybit

Given the complexity of the attack, nothing should be ruled out.

THE TRENCHES ARE COOKED

A wise man once said, ‘Fool me once, shame on you. Fool me twice, shame on me.’ For retail traders in the crypto space, that lesson is finally sinking in after a string of hyped-up launches—Trump, Melania, CAR, Jailstool, and Libra—left them holding the bag.

These projects have followed a familiar script: snipers and insiders scoop up tokens before the contract is announced, only to dump on unsuspecting retail buyers once the price spikes.

This pattern’s become so blatant, that its eroded trust in leadership. Ben Chow, the co-founder both Jupiter (JUP) and Meteora, had to step down amid backlash for his role in feeding clients to crypto supervillian, Hayden Davis. It’s speculated that together, they extracted over $200M from the solana ecosystem.

Since Javier Milei’s $LIBRA coin disaster, the LA VAPE CABAL has been ominously quiet. In fact, it’s been 6 days since Frank Degods, Thread guy or Faze banks tweeted.

It’s likely that they are currently being investigated by authorities for insider trading and other counts of fraud.

Adding to the sell pressure is 11.2 Million Sol ($1.7B) unlocking on March 1st. It’s likely that the market is pricing in this dilution.

👉 Alpha of the Week

Despite the cruel price action, the team at Vybe Network are still hopeful and bullish on 2025 and beyond.

The truth is: the ‘memecoin supercycle’ was unsustainable. Even without max-extractors like Hayden Davis, there were 10’s of thousands of new tokens launching daily and there just isn’t the liquidity to support that market action. Instead, investors should be focused on projects delivering real value.

The Daily Active Users (DAU) for solana programs is still growing.

Programs like Meteora are still seeing huge activity relative to a few months ago.

It might take time for the market to heal and earn back it’s trust, but we are confident in the network’s fundamentals. It would not surprise us if the SOL unlock on March 1st, marks the bottom.

👉 Vybe Announcements

VybeSOL launch is imminent

VybeSOL, our high yield liquid staking token will be launching soon! Unlike other LSTs, VybeSOL will also unlock access to the upcoming Vybe Pro features, which are exclusively available to VybeSOL holders or native stakers through the Vybe validator.

Follow us on Twitter/X and join our Telegram to stay tuned. Some additional benefits planned for early adopters!