Market Vybe #13

WE ARE SO BACK.

👉 Weekly Recap

Good news everyone!

Global markets caught a bid this week as U.S.-China trade negotiations finally showed signs of life.

After weeks of tariff-fueled chaos, including a brutal 145% tax on Chinese imports, investors are clinging to any hope of de-escalation. While India and Japan moved to secure side deals with the U.S., China’s drawing a hard line, warning against any agreements made at its expense. Although there’s been no official breakthrough yet, Trump says a “very good deal” could be on the horizon and that he’s “willing to play ball”.

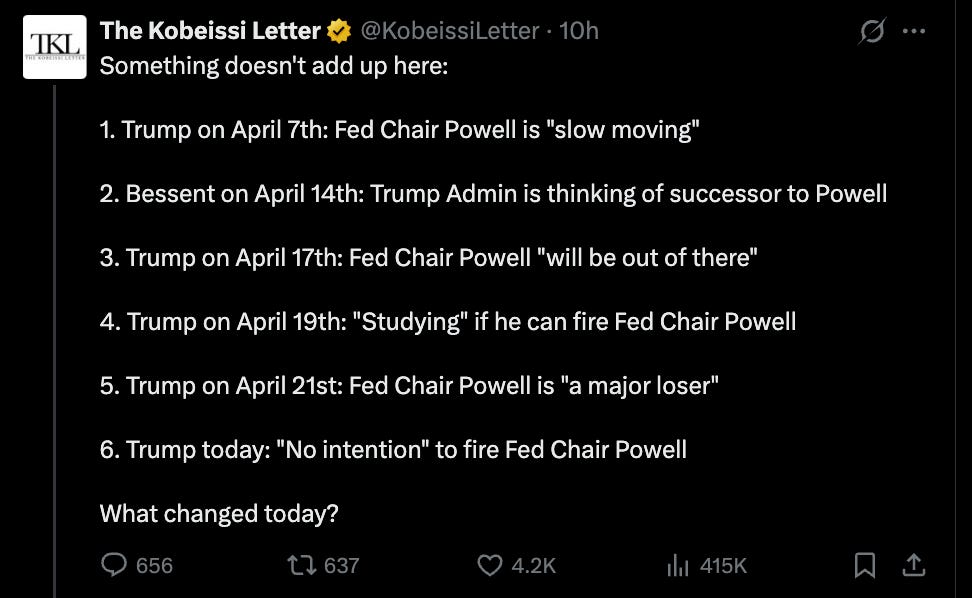

Meanwhile, after spending weeks publicly torching Fed Chairman, Jerome Powell — calling him “a major loser” who’s “always TOO LATE AND WRONG” on rate cuts, Trump suddenly walked it all back. On Tuesday night, he told reporters he has “no intention” of firing Jerome (not that it’s even clear he legally can). This left many analysts wondering, ‘what changed?’

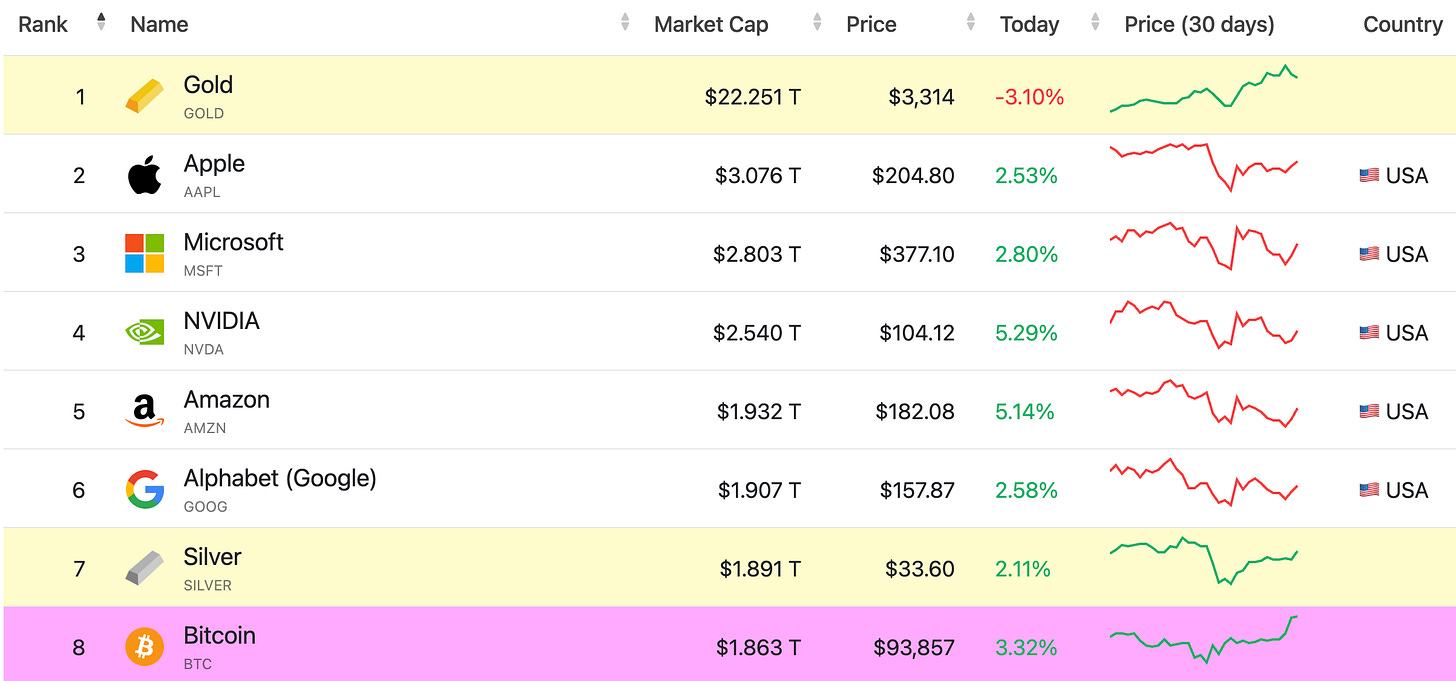

The heightened global economic uncertainty saw gold hit an incredible all-time high of $3,430/oz. Recently, Bitcoin also started to decouple from U.S. tech stocks — flexing its narrative as a hedge against volatility and dollar debasement.

For now, the markets are breathing again.

Here are some other notable headlines:

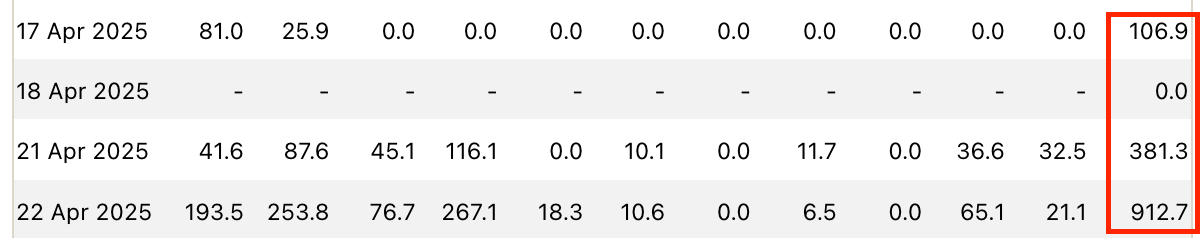

Bitcoin ETF recorded a net inflow of $912 million on Tuesday, April 22nd.

Microstrategy purchases another 6,556 Bitcoin for $556 million

SEC Leadership Shift: Paul Atkins, sworn in as SEC chair on April 21, 2025, is expected to adopt a crypto-friendly stance, potentially easing regulatory pressures.

TECHNICAL ANALYSIS

Just as we predicted in last weeks issue, when Bitcoin broke the purple trend line, it EXPLODED higher. In the last 48 hours, Bitcoin jumped from $84K to $93K. As previously mentioned, getting a daily close above $88K would be a great sign of a reversal.

Looking forward, $95K could be a tough resistance zone, however things are looking very positive for May.

Sol has been up-only since retesting it’s long term support at $100. It’s currently at $150, which could create some resistance. What really stands out is the long-term yellow resistance-turned-support trend line. Don’t be surprised if it bounces off this and then rips through, just like in November 2024 (see above).

👉 Solana News

The market cap of stablecoins on Solana hit an all-time high of 12.8B, 4x the total market cap of stables 1 year ago.

Sol Strategies announces a $500 million convertible note facility to buy Solana

Raydium launched their pumpfun competitor, LaunchLab. So far it has not drawn much interest.

Trump token gets a pump. No doubt market makers are doing some heavy lifting. There is a very aggressive vesting schedule with $6.5M+ tokens unlocking daily for the next 2 years.

👉 Vybe Announcements

Vybe is an official sponsor of Startup Village supporting Canadian participants in the Colloseum hackathon!

We will be hosting workshops at the event and providing free API access to participants. If you plan to participate in the hackathon, connect with us on Telegram for API access keys here: https://t.me/VybeNetwork_Official/1

I like the design of your posts !