Bitcoin is Back + OG Memecoins Surge

Market Vybe #14

👉Weekly Recap

Greetings Ladies and Degenerates,

Welcome back to your weekly roundup of the biggest news in crypto. Bitcoin just posted its strongest weekly gain since the U.S. elections, fuelled largely by massive ETF inflows. Institutional adoption is accelerating, and the regulatory environment continues to ease.

Here’s everything you need to know:

Arizona’s House passed a bill allowing up to 10% of state funds to be invested into a Strategic Bitcoin Reserve (SBR). With this, Arizona becomes the first state to formally create an SBR. 28 other states are in the process of introducing similar legislation.

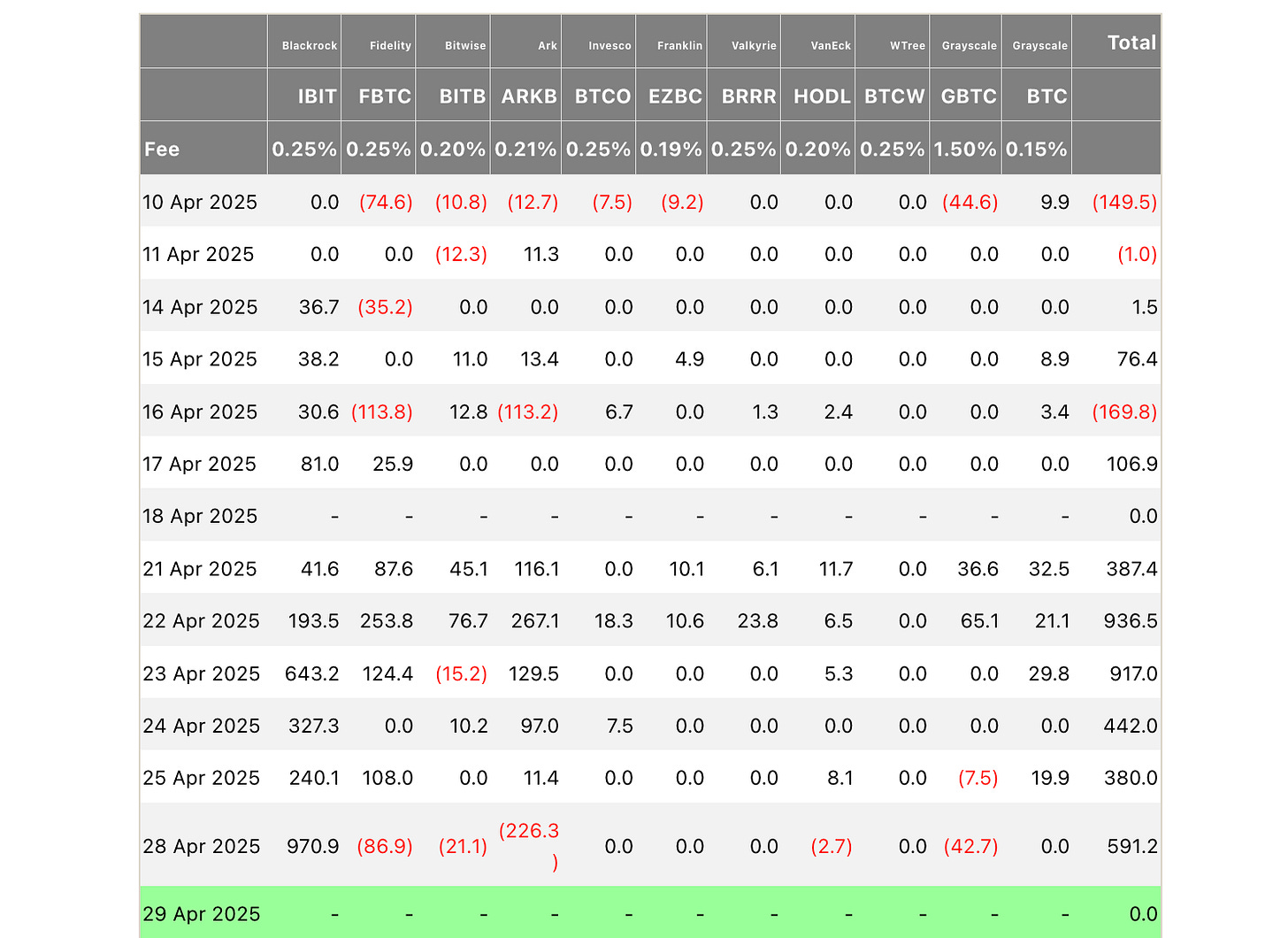

The Spot Bitcoin ETFs saw a huge net inflow of $3.6 billion over the past 10 days. BlackRock’s IBIT alone recorded nearly $1 billion in inflows yesterday. As economic uncertainty lingers, Bitcoin’s role as a global hedge is becoming more obvious.

Meanwhile, MicroStrategy bought another 15,355 Bitcoin for roughly $1.42 billion. They now hold a staggering 535,555 BTC valued around $37.9 billion.

👉Solana News

Institutional Investment Surges: Several major players including DeFi Development Corp., GSR, Galaxy Digital, and Upexi invested nearly $1 billion into $SOL last week.

DeFi Development Corp. filed a $1 billion shelf offering with the SEC to accumulate $SOL, similar to MicroStrategy’s Bitcoin strategy.

Galaxy Digital rotated $105 million out of Ethereum into $SOL. (lmao)

Upexi is eyeing $100 million in Solana accumulation.

Solflare launched its USDC debit card. There are at least five Solana debit card projects currently: Solflare Card, SolCard, Solswipe, KAST Solana Card, and Solacard.

OG Solana memecoins are ‘running it back’. Over the past 7 days:

BTW, check our token page if you want to stay up-to-date on which memecoins are trending.

Technical Analysis

Bitcoin is sitting at a critical level. $95K is major resistance, with $100K the next major milestone if broken. Regardless, we are in way better shape than a month ago.

The Global M2 Money Supply (offset by 3 months) remains one of the most accurate leading indicators. And if the trend holds, new ATH’s could be on-deck for May.

Solana is also pressing up against a major resistance zone at $150. The next big level looks to be around $180. The yellow trendline could be sticky, but if Bitcoin pops here, Solana likely follows.

👉Alpha of the Week

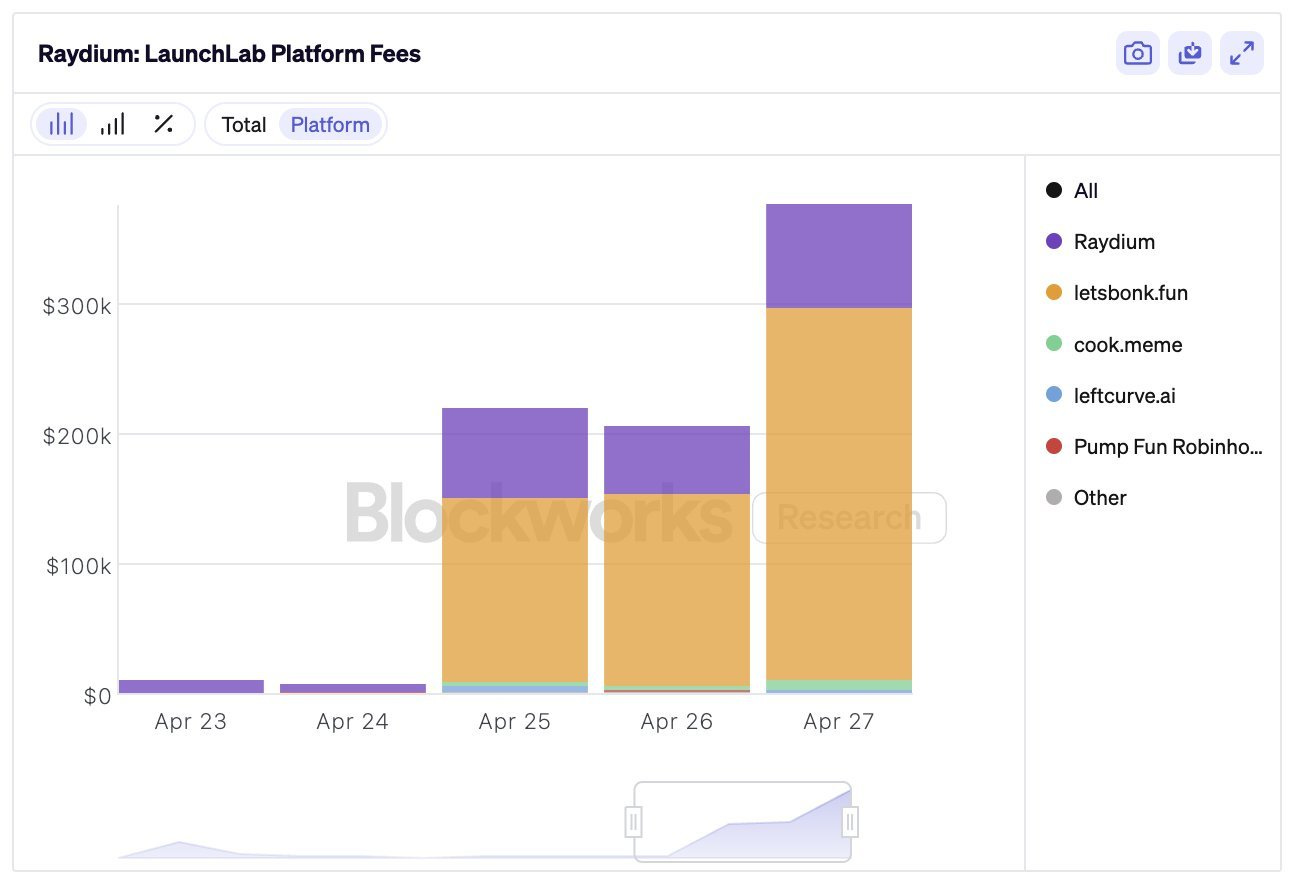

The Solana memecoin launchpad scene(industry?) just got some fresh competition.

Raydium’s LaunchLab stumbled out of the gates, but they’ve now partnered with Bonk to create LetsBonk.fun, combining Raydium’s backend infrastructure with BONK’s diehard community.

As a result, volume spiked, and they’ve already hit a couple multi-million dollar runners like HOSICO and LETSBONK.

And the best part? Fees generated from LetsBonk are being funneled directly back into the BONK chart, which helped fuel it’s +60% rally over the past 7 days.

👉Vybe Updates

The highly successful Redacted Hackathon is wrapping up, with submissions for the Vybe Telegram Bot closing tomorrow. We've had over 80 participants using Vybe APIs to power their Telegram bots.

We’re excited to collaborate with the winning teams and bring their bots to life on our platform. In the next 30 days, we’ll pick winners and highlight the top Telegram bots that stand out!

Vybe at Consensus & Startup Village

Vybe is a proud sponsor of Startup Village in Toronto leading up to Consensus. We have workshops planned throughout the 2 weeks, as well as giveaways and free API codes for participants in the Colosseum hackathon. Follow us on twitter for regular updates from Toronto!