Big Tech, Big TPS, Big Airdrops: Solana’s Next Wave

Market Vybe Issue #16

Welcome back to Market Vybe, your no-BS breakdown of what’s actually going on.

We had some technical difficulties last week, but now we’re back online… and so is the market. Bitcoin just dropped an all-time high like it’s no big deal, alt-season is heating up, and Solana Accelerate delivered some of the biggest updates of the year.

From ETF inflows to the sexiest validator network graph you’ve ever seen, this issue is stacked with alpha. Let’s get into it.

👉 Weekly Recap

Bitcoin hit a new all-time high of $111,800, rallying 33% in just one month. But you wouldn’t know it scrolling through crypto Twitter. Unlike the euphoric $69K peak in 2021, crypto Twitter feels quiet. The lack of hype suggests retail is still on the sidelines, and the real FOMO hasn’t even started.

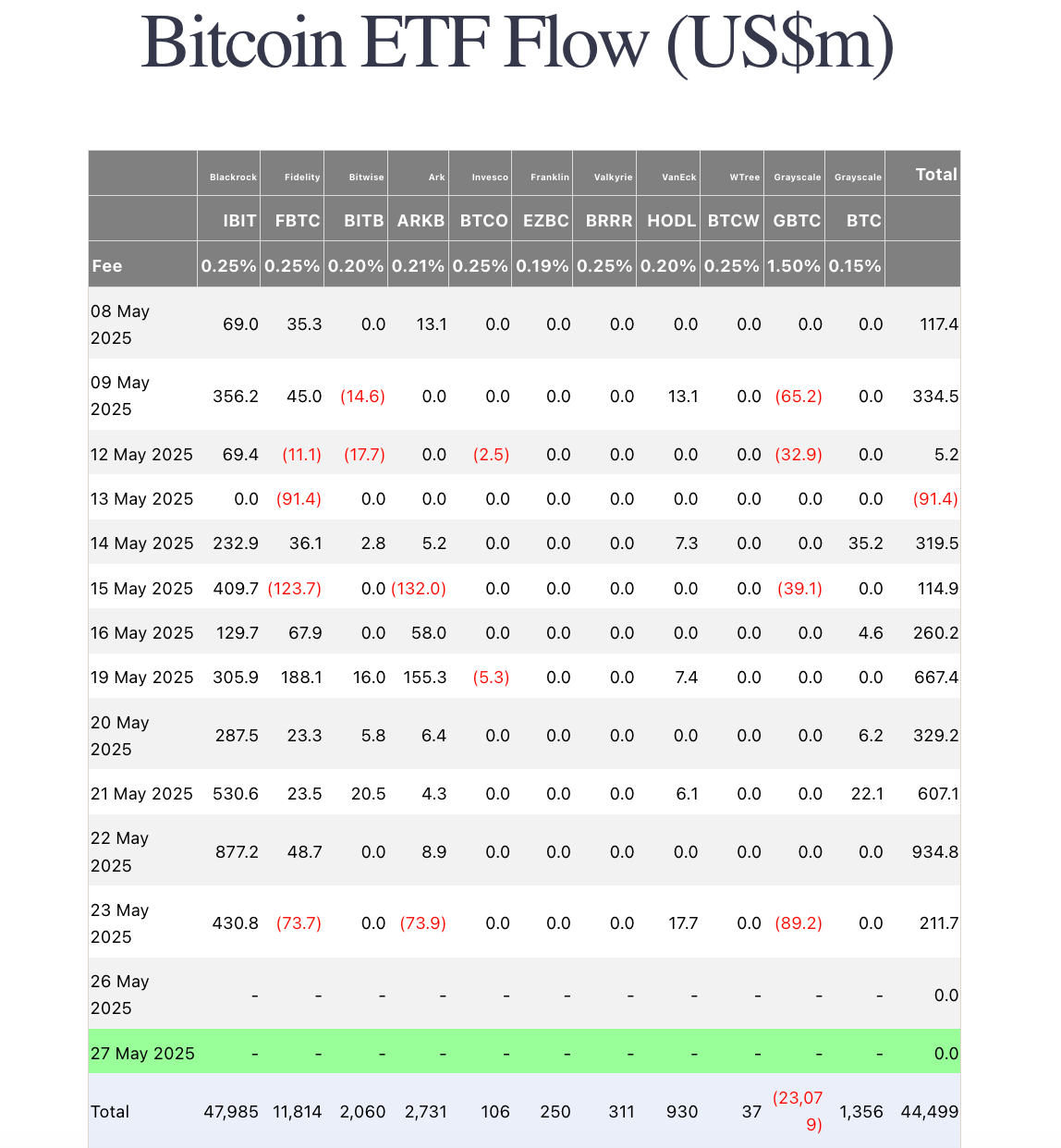

Behind the scenes, though, spot Bitcoin ETFs are pulling in serious capital, with $2.75B in net inflows last week alone.

Combine that with exchange balances at multi-year lows, and the setup looks primed for a melt-up. $200K Bitcoin may come faster than anyone expects.

If your bag holding some underwater positions, you’ll be excited to hear that altseason is upon us. Bitcoin dominance looks like its about to tumble. Generally, when BTC.D falls, that’s when money flows into the riskier assets, like altcoins, memecoins & NFTs.

👉 Solana News

The Accelerate Conference, delivered some MAJOR updates for the Sol ecosystem.

Solana Mobile’s SKR Token and Seeker Phone: Solana Mobile introduced SKR, a token to power its mobile ecosystem, incentivizing developers and users. They also announced the Seeker phone begins shipping August 4, 2025, with 150,000+ units already in production. Potential airdrop opportunity?

Firedancer on Mainnet: Firedancer, Jump Trading’s high-performance validator client, is now live on Solana’s mainnet, but only 5% of stake currently uses it. Capable of 1M+ TPS, it’s still in early stage. There will be a stake delegation program to boost adoption. Full rollout is expected by mid-2025.

Kraken’s Tokenized Stocks: Kraken launched xStocks at Accelerate, bringing tokenized U.S. stocks (e.g., Apple, Tesla) to Solana via BackedFi. This enables 24/7 trading for non-U.S. investors, leveraging Solana’s speed and low fees to bridge TradFi and DeFi.

Jupiter’s Lend Program: Jupiter unveiled Jup Lend, a lending protocol with an 80,000-person waitlist.

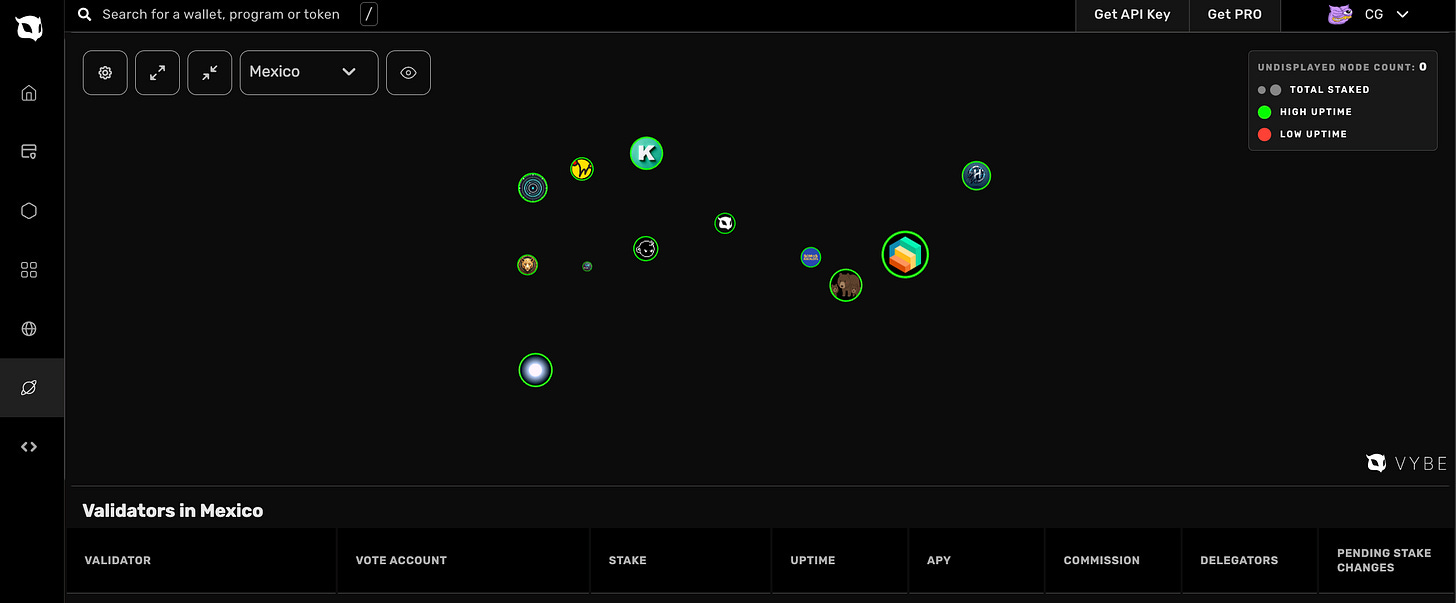

Fidelity, BlackRock, Citadel Validators: Financial giants Fidelity, BlackRock, and Citadel are now running Solana validators, enhancing network security and signalling institutional adoption.

Doodles’ Dreamnet: Doodles launched Dreamnet, an on-chain AI storytelling platform for creating and sharing NFT-based narratives.

Farcaster Adds Solana Support: Farcaster, a decentralized social network, integrated Solana wallet support, enabling token swaps and dApp interactions.

Firefox Supports Solana: Firefox announced they are enabling Solana on their webbrowser wallets after their latest update. Not that anyone still uses Firefox.. but a win is a win.

👉 Alpha of the Week

Circle Internet Financial, issuer of the USDC stablecoin, is set to go public on the NYSE under the ticker "CRCL," with an expected IPO date in early June 2025. USDC, is the world’s second-largest stablecoin with a ~$60B market cap.

The company filed its S-1 in April after a confidential draft in January. This marks its second attempt at going public, following a failed $9B SPAC deal in 2021. Circle is targeting a valuation of ~$6 billion. In 2024, it generated $1.68 billion in revenue, with over 99% coming from interest on USDC reserves. However it also saw net income fall 42% to around $156 million. JPMorgan and Citigroup are lead underwriters; retail investors will gain access post-IPO.

👉 Vybe Announcements

Want to see who’s really running Solana?

We recently rolled out the Vybe Validator Widget this gives you a live, interactive view of validator performance, stake distribution, uptime, and more. So builders & stakers can make more informed decisions when deciding where to place their trust.

Check it out here: https://vybe.fyi/validators