Ansem says the "Top is in.", Here's why he's wrong + Airdrops are back.

Market Vybe #22

Greetings Ladies and Degenerates, and welcome back to the 22nd edition of Market Vybe! Here’s what happened this week, and why we think this dip is an opportunity.

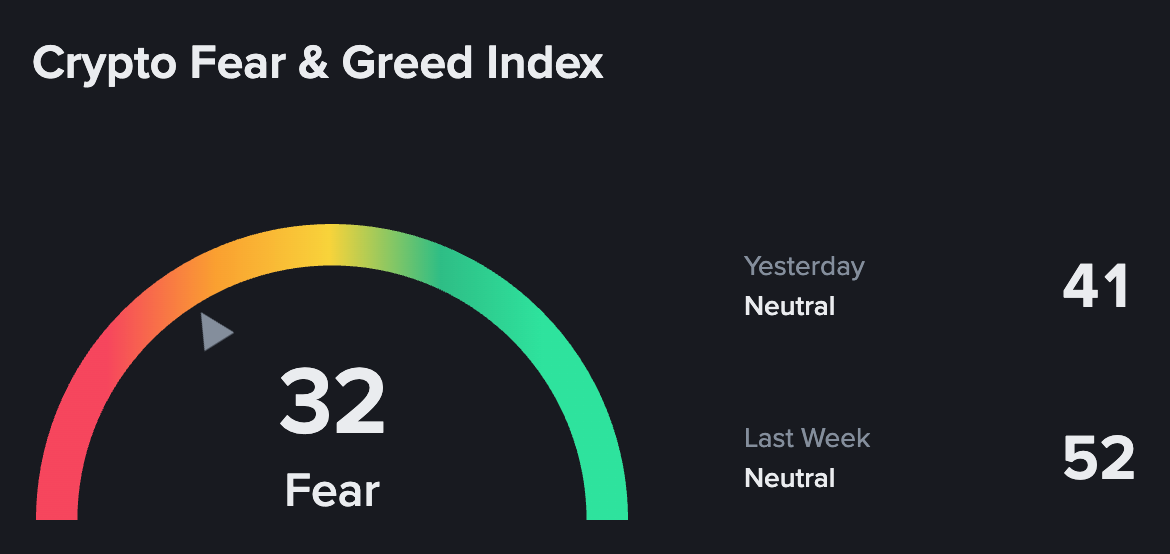

Market Overview

Crypto is seeing a cautious pullback this week, with global market cap down 2.2% to $3.83T, as the Fear and Greed Index ticks higher. Bitcoin (BTC) slipped to a two-week low, dipping under $109K.

Popular X influencer, Ansem, has called for the Market Top, which has divided the crypto community. Although traditional 4-year cycles would put us in the ball park of a cycle-top, many would argue that: the ample liquidity, rate cuts and institutional buying has made the 4-year cycle pattern, irrelevant.

September 21 saw over $1.6B in liquidations, the largest single day of 2025, driven by heavy institutional outflows, including -$360M from Spot Bitcoin ETFs. Some analysts point to the timing of “Triple Witching” as a catalyst.

The Triple Witching refers to the simultaneous expiration of three types of derivatives contracts on the same day:

Stock index futures

Stock index options

Single-stock options

This happens four times a year on the third Friday of March, June, September, and December. This can cause sharp, sometimes temporary moves in equities, as institutions de-risk positions.

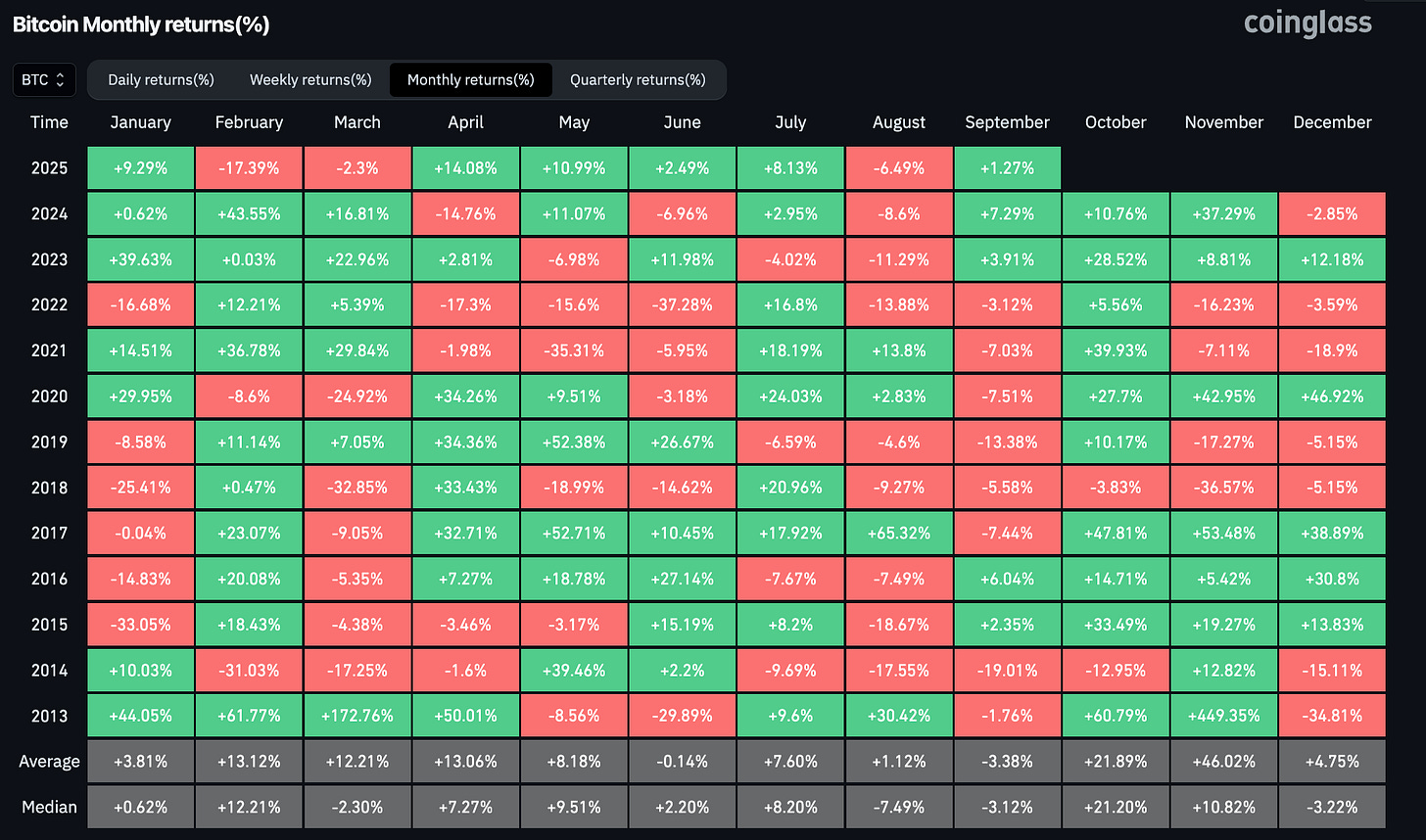

Historical Monthly Returns

September has historically been one of crypto’s weakest months. Since inception, Bitcoin’s monthly returns for September has averaged -3.38%. The good news is that October and November are two of Bitcoin’s best performing months, averaging double digit returns. Patience is key here.

M2: The Bigger Picture

Despite the short-term chop, M2 money supply continues to blaze higher. If BTC simply tracked M2 growth, fair value would already sit near $200K. With more cuts on the horizon and liquidity still expanding, the evidence points to higher asset prices ahead, the current pullback looks more like a blip than a trend.

Meteora hints at token launch

Meteora, a leading Solana DeFi platform for liquidity and trading, is gearing up for its $MET token launch and airdrop this October. The airdrop rewards early users through a points system, with 15% of total supply being allocated: 8% for 2024, 5% for 2025, and 2% for qualifying retail users.

Points accrue at 1 point per $1 of daily TVL provided and 1,000 points per $1 in trading fees generated. Season 1 closed June 30, 2025, while Season 2 is live. You can check your points using the official Meteora Points Checker here.

Estimating Your Airdrop Value (per million pts.):

Aster vs. Hyperliquid

Aster, a new decentralized perps DEX backed by Binance’s former CEO CZ, is quickly disrupting Hyperliquid. Within days of its launch on BNB, Aster hit $12.5B in daily trading volume vs. Hyperliquid’s $10B, while its ASTER token surged 2,800% to a $3.7B market cap.

With $1.25B in open interest and strong fee generation, Aster’s low-cost, high-leverage model is draining liquidity from Hyperliquid. The $HYPE token is down 30% from all time highs, and some traders are calling for a “slow death” as Aster cements its advantage.

Solana News

Solana’s Colosseum Hackathon began on September 25th.

Grayscale Launches Multi-Asset ETF: Grayscale introduced the first U.S.-listed crypto basket ETF on NYSE Arca, including Solana (SOL), Bitcoin, Ethereum, XRP, and Cardano

DoubleZero Mainnet Goes Live: Solana’s dedicated fiber network for ultra-low latency, DoubleZero, launched on mainnet, aiming to boost transaction speeds and support high-frequency trading.

Solana Seeker Phone Ships 150K Units: The crypto-native Solana Seeker smartphone gained strong traction with 150,000 units shipped, featuring built-in Web3 tools to drive mobile DeFi and NFT adoption on Solana.

Vybe Updates

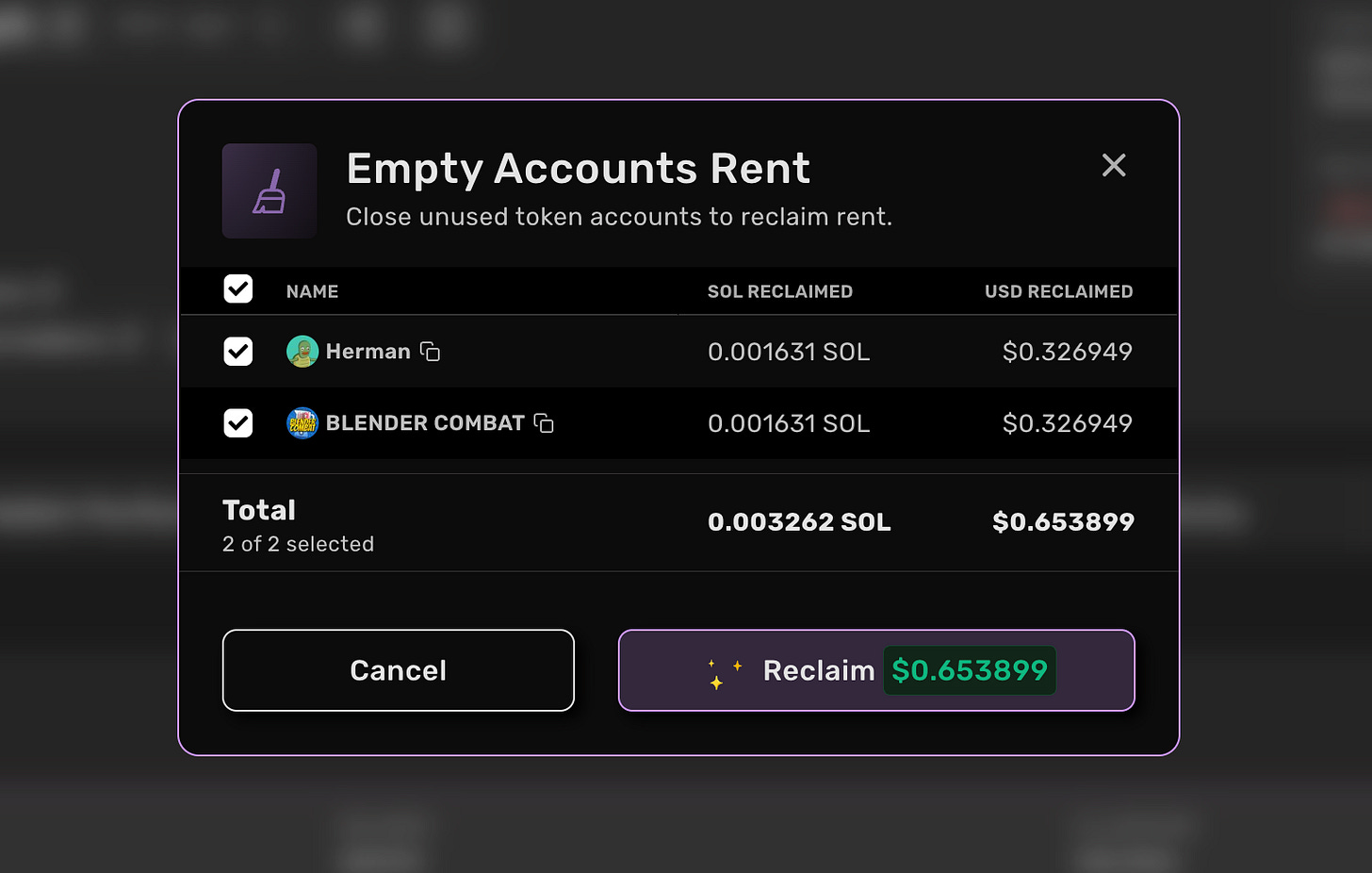

We’ve added a new rent fee + burn function to the Portfolio page — making it easier than ever to reclaim hidden value in your Solana wallet.

Also, proud to share that the Vybe Validator is now running on Double Zero, setting a new standard for reliability and performance. 🚀

Thanks for reading this edition of Market Vybe, don’t forget to hit the ❤️ and share this article.

See you next week,

~ Vybe Intern